by James A. Bacon

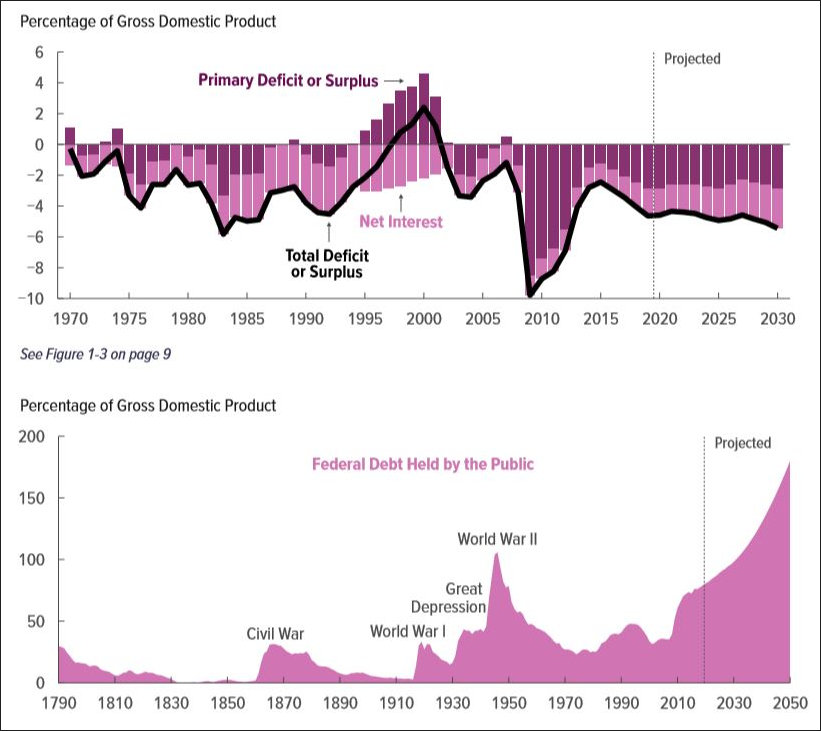

According to the latest Congressional Budget Office (CBO) projections, the federal budget deficit will hit $1.0 trillion in 2020 and will average $1.3 trillion annually for the rest of the decade. Deficits will increase from 4.6% of gross domestic product each year to 5.4%. Most alarmingly, chronic deficits will push the national debt as a percentage of the economy from 81% this year to 98% in 2030, and to a mind-blowing 180% by 2050.

In my book, “Boomergeddon,” written 10 years ago, I went out on a limb and forecast fiscal collapse by the early 2030s, soon after the Social Security trust fund ran out and Congress had to make no-win decisions on how to cope with the inability to maintain retirement payments to seniors. While things still appear dire by 2050, a 98% debt-to-GDP ratio in 2030 looks manageable. Perhaps I was too pessimistic.

The CBO’s not-so-rosy forecast makes one big assumption, however: There will be no recession this decade. The current business cycle is the longest in U.S. history. So unless the geniuses who run the economy have truly figured out how to engineer perpetual prosperity, the U.S. is at extremely high risk for another recession within the next ten years. When it comes, the picture will change dramatically. Let’s see what CBO’s long-term forecasts look like when deficits are running $2 trillion a year!

One other factor I don’t think the CBO takes into account is what happens as the global population ages. Right now, the world is enjoying a capital glut arising from massive saving around the world in anticipation of the retirement tsunami. As people age, they draw down the wealth they’d spent a lifetime building, not just their personal savings but collective savings in the form of pensions and social security programs. And not just in the United States but around the world. Over a 30-year time horizon, it seems inconceivable that the global capital glut will persist. If it doesn’t, interest rates will rise, and the cost of shouldering the national debt will surge… running up deficits even faster.

On the other hand, the CBO does make one pessimistic assumption: that long-term economic growth in the decade ahead will slow to 1.7% annually, driven by slower growth in the workforce. If — a big if — we can sustain annual growth rates of 2% to 3%, the long-term outlook will look much better. That is my only hope that we can avoid catastrophe. Over a long enough period of time, — by the 2060s — all the Baby Boomers will have died off (sniff! sniff!), the entitlement crisis will ease (assuming Bernie Sanders isn’t elected president), and American society just might muddle through.

Everybody’s favorite political game is blaming the other guy for the deficits. Democrats blame tax cuts and military spending. Republicans blame entitlements and soaring discretionary spending. Both are right. Our long-term fiscal outlook stems from the bipartisan compromises made over decades. The only thing that can divert us from our current trajectory is if the next president seriously pursues a fiscally profligate policy such as Medicare for All, free college education for all, or the Green New Deal…. in which things will get worse in a hurry.

Barring such an eventuality, we’re on course for things to get worse slowly but steadily — until the next recession, in which case all bets are off. I still think Boomergeddon by 2035 is a realistic (though not inevitable) prospect.

I’ve preached on this blog that Virginia’s political establishment needs to prepare for the possibility of a federal fiscal breakdown, which would have even more calamitous effects on the Old Dominion than it would nationally. Sadly, Republicans never took the notion seriously, and now Virginia Democrats have thrown all caution to the winds. The only questions are how much will taxes and spending increase, how dependent Virginians will become upon state government programs, and how resilient (or vulnerable) will our economy be to a federal spending shock.

Leave a Reply

You must be logged in to post a comment.