This statue does have to go

The tomb of Confederate General A.P. Hill in Northside Richmond is the latest to be vandalized by red paint or some similar substance, but in this case the argument to move the statute and the grave beneath it should focus on its status as a major traffic hazard.

The vehicles in the intersection at Laburnum Avenue and Hermitage Road look very different than when the body was interred in 1891, and the plants around the base are seldom properly trimmed. Richmond loves traffic circles and intersections with monuments but Richmond drivers simply cannot seem to negotiate them, even with clear visibility (which this location lacks.)

This apparently is the only such statute in a public location that doubles as the honoree’s tomb. Hill’s remains belong in Hollywood Cemetery, with so many other of victims of that tragic war, and the statute can go there or to Fort A.P. Hill (although how much longer active military bases will be named for dead Confederates is also an open question.) Sadly, a debate over safety once started will take on a whole different tenor very quickly.

The Showstopper? Northam Administration’s own data demonstrates federal tax benefits

Defenders of the recent federal tax changes, a kept campaign promise by President Donald Trump and the GOP Congress that remains controversial, need look no farther than a chart distributed on August 17 by Democratic Governor Ralph Northam. It should be particularly useful against Democratic complaints about the tax bill, given the source.

Chainbridge Software LLC, the financial consulting firm selected by the administration to evaluate the impact of the federal tax cuts on Virginia, seems to work mostly in states where Democrats are in control, and the tone of its report is about “revenue lost” or “revenue gained” – in other words, the point of view of the tax collector and not the taxpayer.

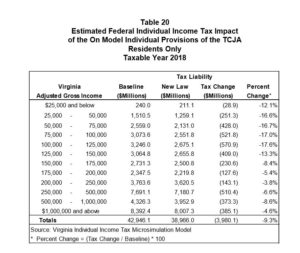

Yet its chart shows 1) federal tax reductions across the board starting with the lowest-income workers, 2) double-digit tax cuts on average for taxpayers with $150,000 in taxable income or less (certainly middle class in many parts of Virginia, and 3) tax cuts averaging less than 5 percent for the richest taxpayers.

At the individual level the situation is complicated and uneven, and Chainbridge also concludes (correctly) many people will not see much if any tax cut and some will pay more. But in general, it concludes Virginia residents’ federal bite goes down almost $4 billion, or 9 percent, and in some income brackets drops 17 percent. Can a White House tweet be far behind?

Back to Richmond traffic: The Brook Road bike lanes

Richmond City Council President Chris Hilbert and Councilor Kimberly Gray have assembled a four-page list of questions (Brook Road Bike Lane Concerns)for the city’s Department of Public Works and are asking they be answered in time for a September 11 community meeting on a proposed dedicated bicycle lane along Brook Road. They are also demanding an updated formal traffic study, arguing new development coming in the area has made the one used in the earlier bike lane decision obsolete.

The plan – previously approved by City Council – remains to take Brook Road down to one lane for motor vehicles in both directions with an entire lane for bikes on both sides. The questions focus on how that will work for homeowners who have delivery trucks coming to their houses, driveways where they back out, or need their trash picked up. They ask what the impact will be on days of heavy activity around Virginia Union University. When the city cuts grass in the median now it temporarily blocks one lane for safety, but that won’t be possible if there is only one lane.

Hilbert and Gray are taking a huge amount of heat from the bike enthusiasts, and the debate started by posts on Bacon’s Rebellion is raging. Whatever the outcome now it won’t be a decision made without some visibility (although the Richmond Times-Dispatch remains oblivious.)

Leave a Reply

You must be logged in to post a comment.