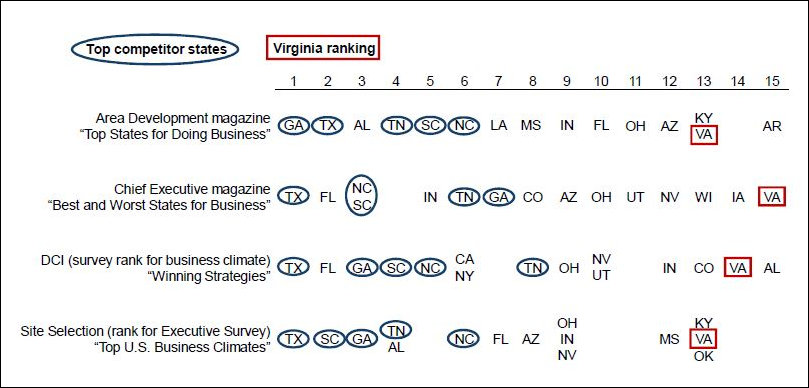

Virginia’s business climate rankings have recovered modestly in recently years, but they remain significantly lower than in its glory days and well behind the states with which the Old Dominion competes for major corporate investment. That harsh reality comes through loud and clear in a presentation made by Stephen Moret, president of the Virginia Economic Development Partnership (VEDP) at a Virginia Chamber of Commerce executive briefing on the business climate yesterday.

Virginia trails its competitors in the perception of relocation consultants on the cost of doing business, the corporate tax environment, business incentives, access to capital, and other key business-climate attributes.

But Moret, who was hired to reinvigorate Virginia’s economic development machinery, has a plan to bolster the state’s business climate. He is working on five targeted initiatives that he thinks can make a big difference.

Create a world-class, turnkey, customized workforce development and training incentive. Workforce typically tops the list of site-selection priorities. While Virginia has a highly regarded public system of higher education, the system does not work closely with economic developers on turnkey, customized workforce solutions for corporations interested in investing in Virginia.

Moret, who developed a highly touted program in Louisiana, said the General Assembly has funded a VEDP-community colleges collaboration to the tune of $2.5 million in Fiscal Year 2019. Once the team is assembled and ready for launch, VEDP will identify three to five pilot projects in preparation for a full launch. His ultimate goal: “Virginia will break into the top five of state workforce development programs in the country within three years, with a solid chance of top three within five years.”

Implement a robust, third-party marketing program. One reason that Virginia’s perception lags among CEOs and site consultants is that competing states market themselves more aggressively. Virginia now has a $1.7 million marketing budget for FY 2019 (and $2.7 million for FY 2020), still short of what is needed to implement a program designed for a budget of $10 million (similar to that of some competing states). But the funding should be sufficient, Moret said, to improve Virginia’s perception as a place to do business among key influencers.

Goals for the marketing campaign include pushing Virginia back into the Top 10 in business rankings, creating 100 additional leads per year, and bringing 5 to 7 additional projects and 1,200 jobs to Virginia per year. A fully funded marketing budget would accomplish commensurately more.

Secure transformational economic development projects that create positive national attention. A small number of high-impact economic development projects, such as Fortune 500 headquarters locations, major auto assembly facilities, and the like, attract outsize national media attention, and influence executive perceptions about business climate. Moret proposed “aggressively courting leading companies with a custom-fit, aggressive approach,” which includes developing “a list of potential custom incentives and investments by region and sector that could be deployed to attract transformational projects.”

The goal would be to snag two or three of these mega-projects per year, gradually covering every region of the Commonwealth, benefiting both urban and rural areas.

Enact targeted tax changes to reduce state/local tax burdens on new business investments and expansions. Virginia’s corporate tax system treats established businesses well but is punitive toward new capital-intensive manufacturing enterprises — indeed, the effective tax burden is the second highest in the country. The tax burden on new investment hurts Virginia’s business climate rankings — the Tax Foundation’s Location Matters scores are incorporated into several state business-climate rankings — and discourages new investment, especially the kind of transformational projects Moret seeks.

Moret’s presentation offered no details beyond suggesting that the tax burden needs to be lower. He proposed collaborating with key stakeholders such as the Virginia Association of Counties and Virginia Municipal League to develop specific proposals.

Assemble more shovel-ready sites. The ready availability of industrial sites served by with all necessary infrastructure often looms larger in corporate investment decisions than incentives. Georgia, Tennessee, and North Carolina often win over Virginia because they have invested in build-ready sites. The lack of prepared sites and buildings have cost Virginia nearly 50 projects and $6.5 billion in investment over the past five years.

Virginia has a “relatively robust portfolio” of project-ready sites less than 25 acres in size, according to Moret’s presentation. But the economic impact is small, so VEDP is focusing on building the portfolio of sites 25 acres or larger, the development costs of which are beyond the scope of any one locality to fund, and often beyond the capability of any one region.

Leave a Reply

You must be logged in to post a comment.