Under a “shock” scenario in which Virginia Retirement System (VRS) investment returns replicated the disastrous performance of the 2008-2009 market crash, the state portion of the retirement plan would see an increase in unfunded liability of $6.9 billion. Employer contribution rates would have to increase to 22% of covered payroll from 13.5% now in order to maintain the integrity of the system. State and local governments would have to cough up hundreds of millions of dollars more in pension payments each year even as a recession was eroding revenues.

Those numbers are found in a recently released report to the General Assembly, “VRS Stress Test and Sensitivity Analysis.” The report is not predicting that such a scenario will occur. Rather the purpose is to show how vulnerable the Commonwealth would be if it did. While investment returns have performed handsomely since the 2008 mortgage-crisis recession, shrinking Virginia’s unfunded pension liability, the global economy is slowing and the strong investment gains of recent years cannot be taken for granted.

Even investment returns on the VRS’s portfolio only modestly lower than the assumed 7% could prove devastating. “If the VRS fund only returned 5% annually each of the next five years, the State plan would see an increase in unfunded liability of approximately $2.2 billion,” the report says.

States the report:

In 2009-2009, financial markets crashed around the world resulting in the worst annual investment performance on record for VRS. This single event caused the funded status of the System to drop nearly 25% in a single year. Since that time, even with the pension reforms and more diligent funding of the state-wide plans by the Governor and General Assembly, the System remains at risk if another investment return “shock” were to occur.

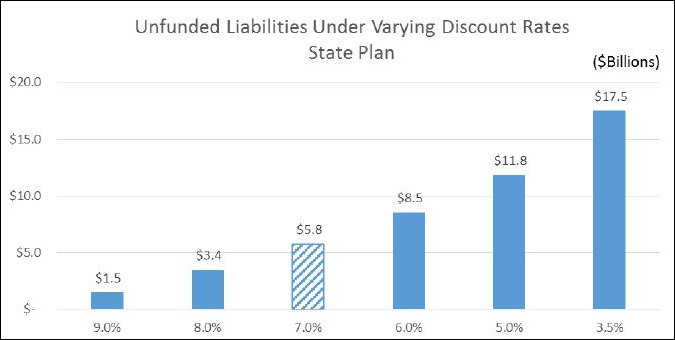

A less dire risk is that after a decade of superior investment returns, the VRS (and global markets) may revert to a sustained period of sub-par returns. Assuming a 7.0% average annual rate of return, a more conservative assumption than that of many states, the VRS calculates that it has a $5.8 billion unfunded pension liability, which at some point will have to be made up either by higher contributions from state/local government or cuts to benefits. If the average rate of return declines to 6%, unfunded pension liabilities would surge to $8.5 billion.

(The report spends significant time discussing a 3.5% “risk free” rate-of-return assumption, which would imply a $17.5 billion liability. While such an assumption might be useful for calculating a settlement value for employers withdrawing from the VRS, concludes the report, it is not a relevant benchmark for the current system.)

What can be done to minimize the downside risk? The report suggests changing the VRS funding policy. In 2013 the amount that state and local governments contribute each year is recalculated based on gains and losses on the investment portfolio and resulting changes to the unfunded liabilities. This gets complicated, so I’ll let the report explain:

One issue with amortizing unfunded liabilities over longer periods of time — such as 30 years — is that during the first nine or 10 years, the interest payments on the unfunded liability will be in excess of the amortization payment, which creates “negative amortization,” so the outstanding balance actually increases during the first eight or nine years … as payments to go toward interest rather than principal.

As of June 30, 2018, the State plan legacy unfunded liability has 25 years of the original 30 years remaining to be paid with an outstanding balance of $7.4 billion. Under the current amortization schedule, $9.1 billion of interest will be paid over the next 25 years on the $7.4 billion outstanding balance.

Shortening the amortization period to 20 years would save the state $2.5 billion in interest payments. The drawback is that employer rates would increase by about 1.7% of covered payroll over that period.

Another strategy, suggests the report, is to maintain contribution levels following years of superior investment performance when the plan experiences actuarial gains, rather than reducing contributions. Such a policy could “create a cushion against future actuarial losses.”

Meanwhile, Virginia needs to consider other long-term funding risks. One is the risk that retired government employees might live longer than currently projected. A 3% increase in liabilities due to gains in longevity would cost statewide plans $167 million in total annual funding. Another risk is a decline in the number of employees contributing into specific plans within the VRS. For example, the number of correctional officers participating in the VaLORS plan has declined from 10,370 in 2008 to 8,717 active members in 2017 as the prison population has shrunk and the state has closed prison facilities.

Leave a Reply

You must be logged in to post a comment.