The Tax Cuts and Jobs Act of 2018 will create 218,000 full-time equivalent jobs across the United States this year, asserts the center-right Tax Foundation, which specializes in analyzing the impact of tax policy on the U.S. economy.

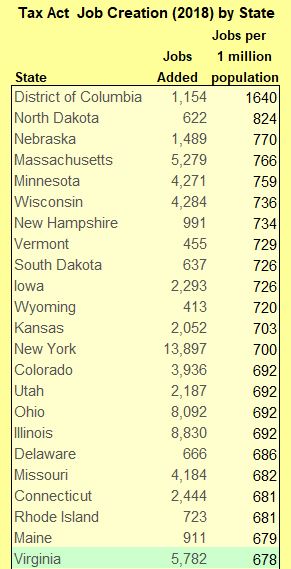

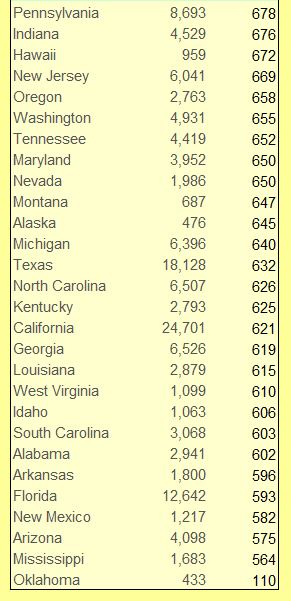

Using its Taxes and Growth econometric model, the Tax Foundation provided a job-creation estimate for each of the 50 states and Washington, D.C. In Virginia, predicts the model, the economic stimulus of corporate and personal income tax reform will create 5,782 jobs.

That number compares to 20,100 total jobs created between Dec. 2017 and May 2018, according to U.S. Bureau of Labor Statistics data. Annualized, Virginia was on track for creating 48,200 jobs in 2018, suggesting that the tax cuts are accounting for about 12% of the state’s job growth.

The tax cuts’ impact on Virginia falls in the middling range compared to other states. The 5,872 jobs created in Virginia amounts to 678 jobs per 1 million population, according to Bacon’s Rebellion calculations. On a jobs-per-population basis, the impact ranges from 1,640 in Washington, D.C. to a mere 110 in Oklahoma, both of which appear to be anomalies. Excluding those two, the impact ranges from 564 jobs per million population in Mississippi to 824 in North Dakota.

Leave a Reply

You must be logged in to post a comment.