Here is more confirmation, as if any were needed, that the Commonwealth of Virginia is running hidden deficits in the form of unfunded pension and retiree healthcare liabilities… Truth in Accounting, a nonprofit devoted to transparency of government finances, gives Virginia a grade of “C” for its financial practices.

By the standards of the 50 states (and District of Columbia), that’s not a bad score. Virginia’s unfunded liability averaging $1,900 per taxpayer is less onerous that that of all but 11 states. So, if you’re inclined toward Pollyanna-ish views on government finance and debt, we’re not doing so badly.

But here’s what Truth in Accounting has to say in its Virginia profile: “Virginia’s financial condition is not only disconcerting but also misleading as government officials have failed to disclose significant amounts of retirement debt on the commonwealth’s balance sheet. Residents and taxpayers have been presented with an unreliable and inaccurate accounting of their government’s finances.”

Highlights:

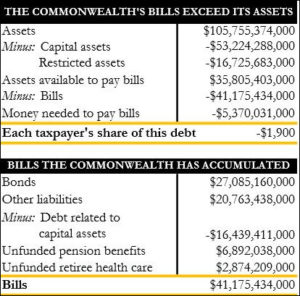

- Virginia has $35.8 billion in assets to pay $41.2 billion worth of bills.

- The $5.4 billion shortfall averages $1,900 per taxpayer.

- Despite reporting all of its pension debt, the commonwealth continues to hide $936.9 million of its retiree health care debt.

- Virginia’s reported net position is inflated by $1.5 billion, largely because the commonwealth defers recognizing losses incurred when the net pension liability increases.

The best funded states are Alaska ($56,000 surplus per taxpayer), North Dakota, Wyoming, Utah, and South Dakota, all of which have set aside more than enough money to pay their pensions and retiree healthcare liabilities. The top “sinkhole” states are New Jersey ($61,400 debt per taxpayer), Connecticut, Illinois, Kentucky, and Massachusetts.

Remember, the Truth in Accounting methodology does not take into account hidden deficits in the form of maintenance backlogs on roads, bridges, mass transit, school buildings, water and sewer plants, etc., much less the potential liability associated with rising sea levels. Nor does it cover the liabilities associated with local governments or a welter of independent and quasi-independent authorities. The fiscal health of the Commonwealth and its localities is far more precarious than even Truth in Accounting portrays it.

The national debt now exceeds $21 trillion, and I read recently that the federal government has unfunded liabilities of roughly $100 trillion over 30 years. Yet Democrats are campaigning on expanding entitlements (Medicare for all, free college for all, etc.) while President Trump is promising another round of middle-class tax cuts. Both political parties are in total denial. The federal budget is unsustainable, and when the national government can no longer maintain its promises and breaks its social contract, and the country slides into chaos, state governments will be the main line of defense against anarchy.

Hint: Do not even think about moving to New Jersey or Illinois. Alaska is looking pretty good right now. Grizzly bears don’t riot or throw Molotov cocktails.

Leave a Reply

You must be logged in to post a comment.