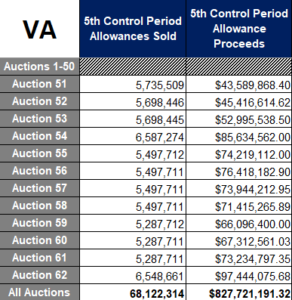

Virginia’s final (maybe) sale of allowances for power plant carbon emissions produced a record $97.4 million. The price for each permit to emit one ton of carbon dioxide, which is passed to customers, has about doubled in four years.

by Steve Haner

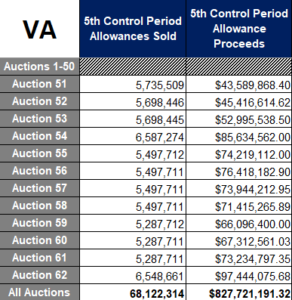

Virginia has participated in its final (for a while anyway) Regional Greenhouse Gas Initiative auction and the proceeds on the carbon tax set a new record, with Virginia collecting more than $97 million in one swoop. The total carbon tax take for the state is just under $828 million in three years.

The clearing price on December 6 reached $14.88 per ton. It would have been higher but the demand for allowances was so high the RGGI organization released some of its “cost containment reserve” or CCR allowances to tamp down the price increase. The news release on the auction is here. A chart showing Virginia’s proceeds over the three years is attached.

Why the record price? Here’s a solid suggestion: Power producers fear another major winter stressing their systems and know full well that wind and solar are unpredictable and unreliable. They are stocking up on allowances to keep our lights on with fossil fuels.

Just four years ago when the Thomas Jefferson Institute of Public Policy produced this explainer on what RGGI was, the “carbon price” was $5.27 a ton and the prediction was Virginia would collect $150 million a year from electricity producers and eventually their customers. “There is no guarantee the price won’t rise,” we noted, and indeed a steadily rising price for carbon emissions is entirely the point of RGGI.

Pushed by Governor Glenn Youngkin (R) the Air Pollution Control Board voted earlier this year to rescind the state regulation that forces Virginia’s larger electric power plants to purchase allowances from RGGI for every ton of coal, natural gas or oil they burn. So far, efforts to reverse that decision in the courts have failed. Continue reading →