At Dominion Energy’s annual meeting earlier this month, shareholders submitted numerous shareholder proposals requiring the energy giant to adopt more environmentally friendly measures. I took note of some of them in my story about the event but never bothered to inquire about the vote results. I’ve attended plenty of annual meetings in my time, and I’d never seen a shareholder proposal opposed by management approved, or even come close to being approved. I didn’t expect any differently this time.

My bad. As it turns out, 48% of participating shares voted in favor of a resolution that would require Dominion to publish an annual statement on the financial risks that climate change poses to the company, according to the Virginian-Pilot. That total was up from the 23.5% of the vote for a comparable resolution at the 2015 annual meeting.

It wasn’t just gadfly nuns and hippies owning a few shares who voted for the resolution. That many votes required heavy support from pension funds and other institutional shareholders. It’s entirely possible that a similar proposal could pass a year from now. The proposal must be taken seriously, for its sponsors surely will be back next year.

Backers of the proposal cast the issue in terms of what is best for Dominion, not environmentalists, the environment or Mother Gaia: Climate change caused by CO2 emissions is unleashing more frequent and more damaging storms, which can expose Dominion’s infrastructure to storm damage, and will engender tighter anti-carbon regulations that could endanger its multi-billion bet on natural gas electric plants and pipelines.

“The three costliest storms in Dominion’s 100-year operating history, Hurricane Isabel, Hurricane Irene and the June 2012 Derecho, have occurred in the last decade,” states the shareholder proposal in the 2016 proxy statement. “The consensus among climate scientists is that without significant reduction of greenhouse gas emissions, climate change will continue to result in more severe and frequent storms, among other effects.”

Dominion’s restoration costs were $128 million for Hurricane Isabel in 2003, $59 million after Hurricane Irene in 2011, and $42 million after the derecho. “Additionally, between 2011 and 2012, weather events, earthquakes, and environmental regulations imposed more than $450 million in costs on the company, adversely affecting its earnings.”

Also, argued a memorandum in support of the proposal, the company does not seem to be taking into account federal or state legislation that could “either mandate greater deployment of renewable energy or assess financial penalties for the continued use of fossil fuels.” Dominion could be “betting the company” that changing laws, regulation and consumer tastes won’t leave the company with billions in stranded, uneconomic assets.

“Dominion faces serious financial challenges with regard to climate change risks that are not being addressed,” says the memorandum. “Dominion should be required to provide adequate climate risk assessments, including clearly defined actions the Board intends to take to address these risks.”

Dominion responds. Dominion management advised shareholders to vote against the proposal. Committed to being a good environmental steward, Dominion is pursuing an integrated strategy to reduce greenhouse emissions based on a diverse fuel mix, including gas, nuclear, hydro, wind and solar, the company stated. Between 2000 and 2015, the company has reduced the carbon intensity of its generating fleet by 43%, and it has forecast that carbon intensity will fall another 25% as it expands solar production to 5,200 megawatts over the next 25 years.

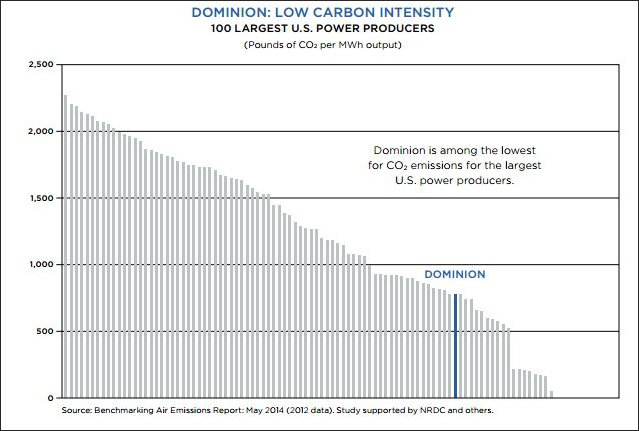

Dominion says it is one of the lowest carbon-intensity electricity producers in the U.S. Producers at the lowest end of the scale are pure-play renewable companies.

Also, the company responded in the proxy statement, it already reports on financial risks relating to climate change in its 10-Q forms and in its Citizenship & Sustainability Report. Three years ago, it published the “2014 Dominion Greenhouse Gas Report.”

As for the charge that Dominion isn’t taking into account the potential for tighter carbon emissions, in remarks made during the shareholders meeting, CEO Tom Farrell said that carbon regulation is coming. While some politicians have suggested that the Trump administration will roll back the Obama administration’s Clean Power Plan, Farrell said that the EPA is legally required to regulate CO2 emissions, and that a McAuliffe administration study group will come out with state-level recommendations in June.

Bacon’s bottom line: One can argue with the premises of the shareholder proposal, but it really doesn’t matter if the authors are right or wrong in their particulars. What matters is whether shareholders owning a majority of shares believe they are right. If a few more shareholders agree, joining those in the 48%, they could push through their proposal a year from now.