The deduction of mortgage interest from the federal income tax reduced the United States tax base by about $470 billion in 2008. The tax break is justified as a tool to promote home ownership but, by overwhelmingly favoring upper-income Americans, it mainly encourages them to buy more, or more expensive, houses than they otherwise would. Renters with lower incomes who would like to become homeowners derive minimal benefit because they tend to be in lower tax brackets. So argues “Unmasking the Mortgage Interest Deduction: Who Benefits and by How Much?” published by the Reason Foundation.

As Congress wrestles with balancing the budget and restructuring the tax system, it should consider eliminating, or at least phasing out, this loophole. Zeroing out the mortgage interest deduction (MID) is certainly preferable to raising general tax rates, as some would like to do. Closing the loophole also would have the salutary effect of reducing the unproductive over-investment in residential real estate.

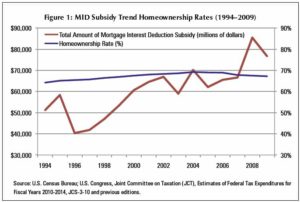

Authors Dean Stansel and Anthony Randazzo make several important points. The MID does little to promote home ownership. The chart to the left shows virtually no correlation between the MID subsidy and the home ownership rate since 1994. (Click on chart for more legible image.)

Authors Dean Stansel and Anthony Randazzo make several important points. The MID does little to promote home ownership. The chart to the left shows virtually no correlation between the MID subsidy and the home ownership rate since 1994. (Click on chart for more legible image.)

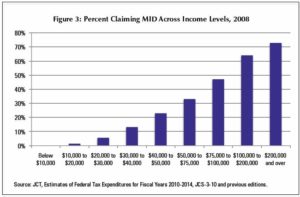

The reason is that non-homeowners, who tend to be Americans in lower tax brackets, would derive no benefit from the MID if they bought a home. The authors explain: “Lower-income taxpayers are far less likely to itemize deductions because the sum of those deductions would be lower than the standard deduction, and even when they do itemize, the incremental benefit over and above the standard deduction is often quite small. Furthermore, for those who do claim the MID, higher income taxpayers tend to benefit more because they face higher marginal tax rates and tend to have larger mortgages.”

The chart to the left shows how the benefit from the deductions goes overwhelmingly to the most affluent Americans. (Click on chart for more legible image.)

The chart to the left shows how the benefit from the deductions goes overwhelmingly to the most affluent Americans. (Click on chart for more legible image.)

Realtors and home builders will defend the MID to the death because the loophole does stimulate the construction of bigger, more expensive houses as well as vacation homes. But no one has yet explained the social benefit of subsidizing the installation of Pella windows, granite counter tops and four-car garages. Nor has anyone articulated a compelling national interest for building more second homes in ecologically fragile beach fronts and wilderness areas.

Talk of raising the general federal income tax rate on “the rich” without eliminating the MID is just obscene. Such a policy would increase the value of the MID to the wealthiest Americans, encouraging even more over-investment in high-end housing and second homes.

In Bacon’s ideal world, Congress would figure out how to balance the budget without increasing the overall tax burden of the American people. Elimination of the MID would be offset in a revenue-neutral way by lower general tax rates. If people want to buy million-dollar McMansions or ski chalets in Vail, they’d still be free to. They just wouldn’t be subsidized anymore.