About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Extensive Plagiarism Alleged for UVA PhD Dissertation

- Some Rural Localities Hit With Big Jump in Local Composite Index

- The Budget Do-Over: A Game of Chicken?

- Jason Miyares–Judicial Activist?

- State Legislatures Control Budgets — Virginia’s More Than Most

- Jeanine’s Memes

- Bacon Meme of the Week

- Ready for Taxes on Netflix, NFL Sunday Ticket?

- Keffiyehs, Yarmulkes and “Belonging” at UVA

- Public School Enrollments Still Declining

- The Incredibly Shrinking Newspaper

- Diamonds Aren’t Forever

- Will Democrats Shut Down State Over Tax Hike?

- Fairfax Spends More, Teaches Less

- Jeanine’s Memes

Bacon Meme of the Week

Posted in Uncategorized

What the School-Discipline Meltdown Looked like in Newport News

A special grand jury investigating a six-year-old’s shooting of a teacher at Richneck Elementary School in Newport News has released its report, and the findings are almost as horrifying as the shooting itself.

The grand jury indicted Richneck’s assistant principal Ebony Parker on eight counts of child abuse. It is the first time, suggests The Washington Post, that an administrator has been charged in connection with a school shooting.

While Parker’s inaction was surely inexcusable, the breakdown in safety runs far deeper than the negligence of a single school official. The behavior of Parker and other individuals reflects institutional dysfunction, which in turn reflects deep-rooted attitudes in the educational profession and society at large.

These dysfunctions and attitudes, I suggest, are endemic throughout most of Virginia’s public education system. They are reflected in widespread reports of violence against teachers all around Virginia, especially in school districts where “progressive” ideology is dominant. Abigail Zwerner, victim of the six-year-old’s attack, may be the only Virginia school teacher to have been shot in recent years, but hers is no isolated instance of violence. Continue reading

Posted in Uncategorized

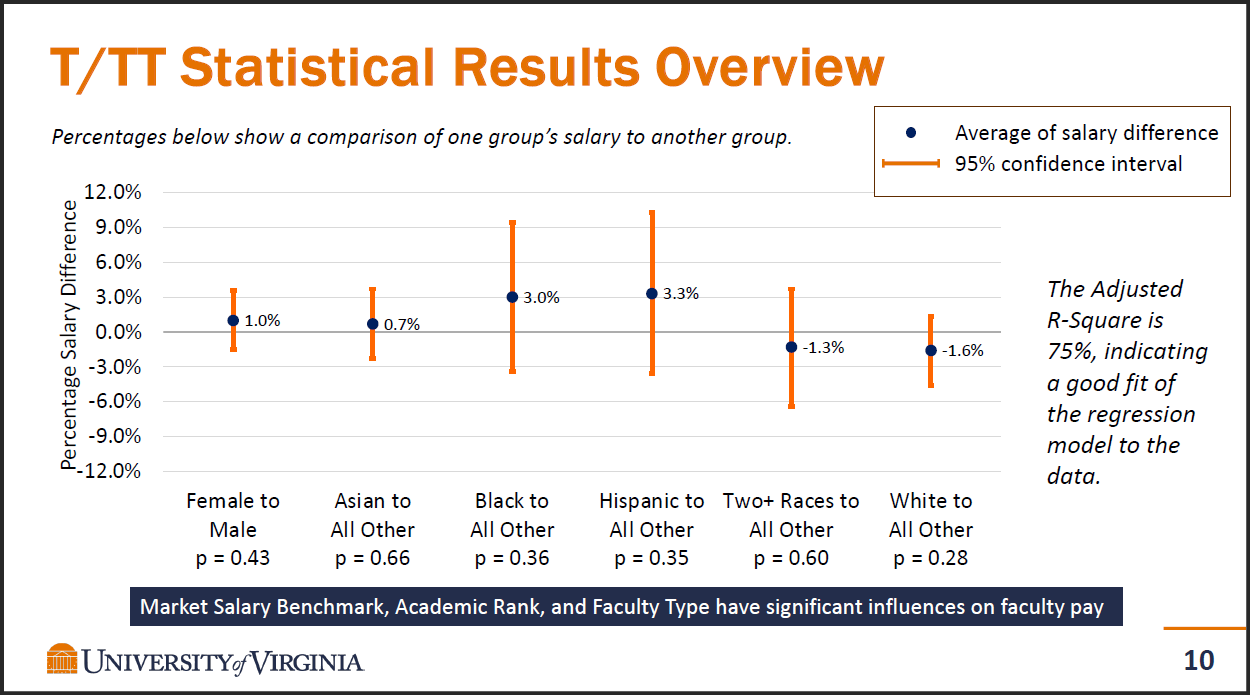

UVA Report Finds No Pay Inequity for Black, Hispanic Profs

Adjusted salary differentials for tenure/tenure track faculty.

by James A. Bacon

The Racial Equity Task Force, a 2020 document that transformed governance at the University of Virginia, listed 12 top priorities for addressing the legacy of historical racism. One was to address “serious challenges to racial equity in staff hiring, wages, retention, promotion, and procurement” by auditing where policies and procedures might be “reinforcing entrenched inequities.”

The report cited no actual evidence of disparities in pay, and the authors did not assert that they existed. In a report that lambasted UVA as “an inaccessible, rich, ‘white’ institution,” pay inequities were just assumed to occur and needed to be documented.

Well, last year the Ryan administration hired the DCI Consulting Group to evaluate “pay equity” for UVA faculty based on gender and race. The results, based on 2022 compensation, were made available to UVA January 5 and, sure enough, pay inequities were found…. for non-tenured Asian-American faculty.

Remarkably, adjusted for their level in the academic hierarchy, seniority and other variables affecting compensation, Black professors who are tenured or on the tenure track were f0und to earn 3% more than their peers, Hispanic professors 3.4% more, and Whites 1.6% less — although DCI did not deem the differences to be “statistically significant.” Continue reading

Posted in DEI, Education (higher ed), Race and race relations

Tagged James A. Bacon, University of Virginia

Utilities Will Gamble on Nukes With Your $$$

By Steve Haner

Standing firm against raising taxes is a fine thing, but it would help if Virginia’s leaders also stopped using people’s electricity bills to fund rent-seeking energy speculations.

Governor Glenn Youngkin (R) has tweaked, but not vetoed, pending bills that allow both of Virginia’s investor-owned utilities to charge ratepayers for power plants that may not be built. The dream projects involve small modular nuclear technology, proven in military applications but so far speculative for commercial generation. Continue reading

Posted in Energy, Environment, General Assembly, Regulation, Utilities

Tagged APCO, Dominion, Stephen D. Haner

Are Nonchalant Adults Responsible For School Shootings?

by Kerry Dougherty

by Kerry Dougherty

Finally.

For instance, the former assistant principal at Richneck Elementary School in Newport News — Ebony Parker — has been indicted on eight criminal charges in connection with the shooting of first grade teacher Abigail Zwerner in January 2023.

This stunning act of senseless violence put Newport News in headlines around the world. After all, it isn’t often that a 6-year-old carries a loaded gun to school and attempts to kill his teacher.

The mother of the shooter, Deja Taylor, is in prison. She’s serving 21 months on federal gun charges and two years on state charges of felony child neglect.

But there is plenty of blame to spread around in this shocking case.

School officials were warned repeatedly about this boy’s antisocial and dangerous behavior. Yet he remained in a classroom with normal kids. On the day of the shooting at least one child reported that the kid had a gun and school administrators failed to take the report seriously.

In fact, according to a civil suit filed by Ms. Zwerner, who is seeking $40 million in damages, the shooter was a persistent discipline problem. He’d been kicked out of kindergarten and sent to another school after he reportedly tried to strangle and choke his teacher.

On the day of the shooting, Zwerner reportedly told Parker that the child was in a “violent mood.”

Yet nothing was done. Continue reading

Fighting Over the Check at the Green Power Cafe

New power plants are pretty useless unless they are connected by new power lines. The debate over who pays for those tall towers and miles of cable can be just as divisive as the fight over who pays for a proposed nuclear plant or offshore wind turbines.

Bottom line, of course, the customers ultimately pay. But which customers? Should it be those most reliant on that individual transmission line, everybody within the utility, or should it be all the customers within all the utilities inside a regional transmission organization? Continue reading

Governor Leaves Consistency and Principle Behind

Playing a “skills game”. Photo credit: Virginian Pilot

by Dick Hall-Sizemore

With his proposed amendments to legislation regulating “games of skill,” Gov. Youngkin has demonstrated deep inconsistencies, if not outright hypocrisy.

Before getting into the specifics, a little background is needed.

“Games of skill” are machines on which people can play and win money. The proponents of the machines claim that some element of skill is needed to win. The opponents claim that the machines are not that different from slot machines, in which pure luck is involved. Not having played any “games of skill,” I am not going to offer any judgment on this argument.

Skill games are present in many, if not most, convenience stores, truck stops, and even some sit-down restaurants, such as the Kelly’s Tavern franchise in Virginia Beach. The machines themselves are owned by large corporations, mostly from out of state. The owners of the venues receive an agreed-upon share of the revenue generated by the machines. The revenue can be significant and many of the businesses have come to depend on it. Continue reading

Jefferson Institute’s Hit List Bills Mostly Gone

Monday was not just the near total solar eclipse in Virginia, but also the deadline for Governor Glenn Youngkin (R) to act on the budget and the remaining bills on his desk. As our Steve Haner wrote, in “Governor’s Budget Compromise Eclipses Fears of Stalemate,” we are generally positive about the approximately 230 budget amendments Governor Youngkin made.

The Governor sacrificed two-thirds of his spending priorities while giving Democrats almost all of theirs. He did this while removing any tax increases from the budget and forgoing all of his recommended tax reforms (reductions). This was more than a good faith offer and should be embraced by any member of the General Assembly, Democrat or Republican, serious about getting a budget compromise passed before the end of the fiscal year.

Just before midnight on Monday, Governor Youngkin acted on the last of the 1,046 bills he had been sent this legislative session. The final tally: he signed 777, proposed amendments for 116, and vetoed 153. He will have a second chance to veto bills where his suggested amendments are rejected.

While I am sure much will be made of the record number of vetoes, Democrats in the General Assembly opted to send a wish list of bills to the Governor that they knew would never get his signature. Nor would some have even passed the muster with previous Democratically controlled General Assemblies or liberal Governors around the country. This is due, in part, to the retirement or defeat of the more moderate members of the Democratic caucuses in the General Assembly. Continue reading

Posted in Budgets, Business and Economy, General Assembly, Labor & workforce, Taxes

Tagged Derrick A. Max

Youngkin Kicks the Can Down the Road on Affirmative Action

by Jock Yellott

by Jock Yellott

By partisan votes, the Democrat controlled General Assembly presented Republican Governor Youngkin with HB 1404, mandating affirmative action in Virginia government contracts.

Bacon’s Rebellion published a piece that listed the bill as a veto candidate. One of those that would “have the greatest negative economic impact on the Commonwealth.”

But instead of a veto, at the 11th hour on Monday April 8, 2024 Governor Youngkin proposed amending it.

The amendments would postpone its effective date for a year — if reenacted by the General Assembly. Meantime, let’s have more “input.” Continue reading

Posted in Business and Economy, Economic development, General Assembly

Tagged Jock Yellott

A Flood of Budget Amendments

by Dick Hall-Sizemore

Well, Gov. Youngkin has not carried through on his veiled threat to veto the entire budget–yet.

Instead, he has proposed more than 230 amendments that would get rid of the expansion of the sales tax to digital services that the General Assembly passed, along with an extra $1 billion in expenditures that would have been funded with that additional revenue. (Source: Cardinal News.)

To really get a sense of what new spending he is proposing to reduce or eliminate, one would need to laboriously construct a detailed spreadsheet or database. I will wait for the analysis that the staff of the money committees produce. They are likely working on it now.

Two quick observations:

1. Sen. Scott Surovell (D-Fairfax), the Senate Majority leader, in responding to the governor’s actions, relied on a common misconception regarding the Virginia budget. Worrying about packaging amendments that cut revenue with amendments that change spending, he speculated, “You’ll end up having a constitutionally unbalanced budget, which would be illegal.”

Contrary to popular belief, there is nothing in the state constitution that requires the General Assembly to pass a balanced budget. What the constitution does is put the responsibility on the governor to execute a balanced budget. Article 10, Section 7 requires that the “Governor, subject to such criteria as may be established by the General Assembly, shall ensure that no expenses of the Commonwealth be incurred which exceed total revenues on hand and anticipated during a period not to exceed the two years and six months period established by this section of the Constitution.”

It would politically irresponsible and risky for the General Assembly to pass a budget bill that was purposely unbalanced, but there is no constitutional prohibition on its doing so. The constitution does require, however, that the governor clean up whatever mess the legislature may create by doing so. (This is one of the many things that Ric Brown, the long-time deputy director and director of the Dept. of Planning and Budget and Secretary of Finance, taught me.)

2. I am so glad that I am retired and did not have to experience the grueling hours that the DPB staff had to put in over the last few weeks to develop these amendments.

Compromise Budget Can Eclipse Stalemate

By Steve Haner

Governor Glenn Youngkin (R) is offering a compromise on the disputed state budget that gives Virginia’s Democratic legislators most of the spending they were initially demanding, especially for local schools and early childhood education. The Governor is also offering a quick path to a resolution that avoids additional months of budget stalemate and political division.

“On a day when Virginians were thrilled to witness an 80% eclipse of the sun, they should also cheer a budget compromise where a Republican governor moved about that far in the direction of meeting the Democrats’ stated goals without added taxes,” stated Derrick Max, President of the Thomas Jefferson Institute. “This is a more than reasonable good faith offer, recognizing that in a divided government, compromise is key.” Continue reading

Posted in Budgets, Business and Economy, General Assembly, Taxes

Tagged Stephen D. Haner

An Epidemic of Stars and Medals Inflation

by Thomas M. Moncure, Jr.

by Thomas M. Moncure, Jr.

We live in a time when every kid gets a trophy just for participating. Grade inflation has made C’s obsolete … where we still have grades. Awards shows seemingly appear on TV every week. And – if the last session is any indication – every person and organization in Virginia is eligible for a commending resolution from the General Assembly. (See Commendations.)

An inflation of symbols and merit has particularly afflicted the military. Every corporal now sports enough ribbons and badges to be mistaken for a South American general. Flag grade officers have several rows of ribbons up to their shoulders. Soon, these officers will need to have sashes – a la the Girl Scouts – to display all the ribbons. And as a sash might cover other badges on their uniforms, they may need a sash-bearing aide in tow. Or, they could just pin badges on their pants, North Korean style.

George C. Marshall was a veteran of World War I, Army chief of staff, and architect of victory in World War II. He was promoted to five-star general to put him symbolically on par with British field marshals. In his formal portrait at the end of World War II – wearing five stars – he displayed a mere three rows of ribbons. Continue reading

New Novel: Midnight’s Broken Toll

by Joe Fitzgerald

All politics is personal. So it’s an open question why Mickey MacNamara runs for the state Senate. Is it to win the job or to hurt the man who holds the seat? The incumbent had a hand in the failures of Mickey’s father; Mickey has the time and resources to try and make him pay.

The opportunity to deliver the killing blow falls into Mickey’s lap late in the game. His October surprise ripples through his life and the lives of those around him. It echoes in ways he didn’t expect, can’t stop, and barely understands.

Careers in politics and journalism prepared the author to write Midnight’s Broken Toll. The music of his life runs through it like a soundtrack.

Joe Fitzgerald is a former mayor of Harrisonburg.

Eclipsing Speech in RVA

Richmond City Hall

by Jon Baliles

Last month, City Council applied a few new stringent guardrails to public comment at Council meetings by altering their Rules of Procedure under the guise of “streamlining” meetings.

Now, I am all for free speech, but I also understand that people showing up to Council meetings to push for a ceasefire, fight world hunger, or colonize Mars (i.e., things Council can’t do anything about) takes up valuable time on issues that Council should be addressing (or trying to address). City Council is granted specific powers, and resolving world issues is (thankfully) not one of them. The business of local government is local and decidedly unsexy: trash pickup, potholes, schools, housing, public safety, transit, development, etc.

Council used to limit each public comment session at each meeting to eight speakers who sign up beforehand with the City Clerk with a brief description of their topic and are each given three minutes to speak. The new rules do not apply to people speaking to issues on the Consent Agenda or Regular Agenda or budget meetings; but lately, almost all of these eight Public Comment slots have been taken by people calling for or against issuing an official resolution for a ceasefire in Gaza, even though Council has not discussed any such resolution. Continue reading