The United States devotes nearly 20% of its economy to health care but is widely regarded as getting less for its money than most other countries with advanced economies. What is driving costs so high? The Wall Street Journal suggests some answers, which totally vindicate Bacon’s Rebellion’s analysis in every regard. The Journal’s bottom line:

Americans aren’t buying more health care overall than other countries. But what they’re buying is increasingly expensive. Among the reasons is the troublesome fact that few people in health care, from consumers to doctors to hospitals to insurers, know the trust cost of what they are buying and selling. In some cases, costs are largely secret. Providers, manufacturers and middlemen operate in an opaque market that can mask their role and their cut of the revenue. Mergers give some players more heft to enlarge their piece of the pie.

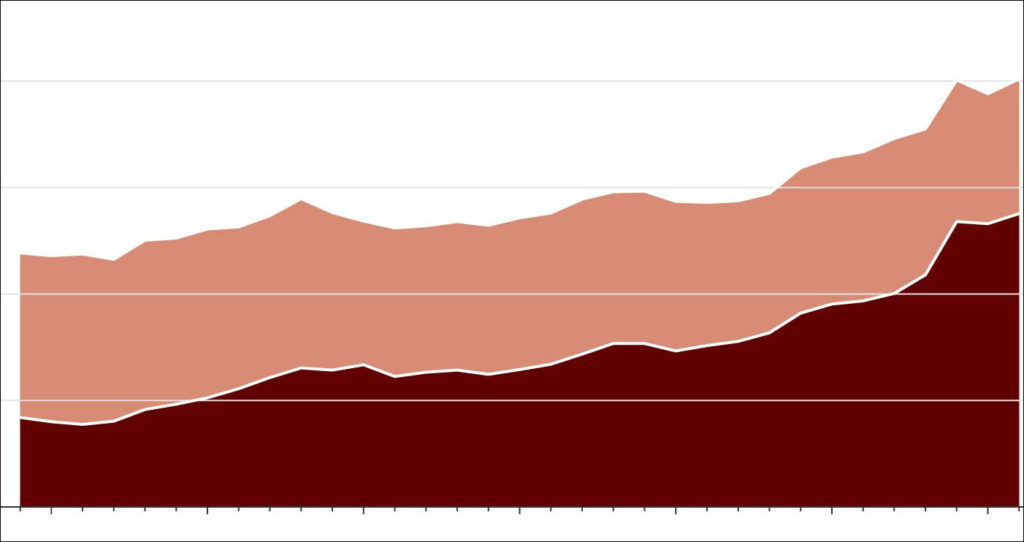

This chart shows how health care is hogging an ever-increasing share of consumer expenditures on health care. Notice where most of the growth is coming from — health insurance. Consumers are spending less out of their own pockets and more, indirectly, through Medicare, Medicaid, and private insurance. Explains the Journal:

Contributions to employer-sponsored health coverage aren’t taxed, which makes it less expensive for companies to pay workers with health benefits than wages. Generous benefits lead to higher spending, according to many economists, because employees can consume as much health care as they want without having to pay significantly more out of their own pockets.

The tax benefit is the country’s biggest single income-tax break, amounting to an $854 billion subsidy.

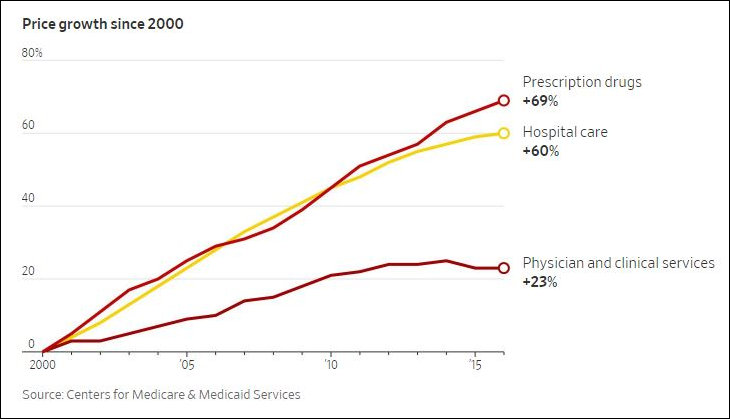

Meanwhile, thanks largely to state and local regulatory policies, the hospital industry is consolidating and health care systems are exercising greater power in the medical marketplace than ever before. Inflation in hospital prices, along with inflation in pharmaceutical prices, are driving health care cost increases far more than charges for physician and clinical services, as can be seen above.

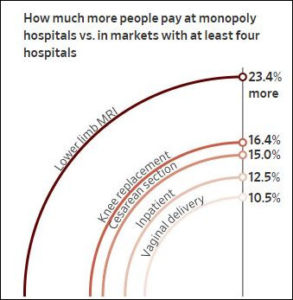

Research shows that competition does matter. In markets with less competition, consumers pay more for common procedures, as seen in the chart to the left. The revenue of health care companies represented nearly 16% of the total revenues of firms in the S&P 500 last year, up from about 4% in 1984, states the Journal. (Presumably, that does not include revenues of nonprofit healthcare companies. They, too have, soared.)

Here in Virginia, profitability of healthcare companies is extremely healthy. While a handful of rural hospitals are losing money, the big hospital chains and healthcare systems are immensely profitable — regardless of whether they are for-profit or nonprofit.

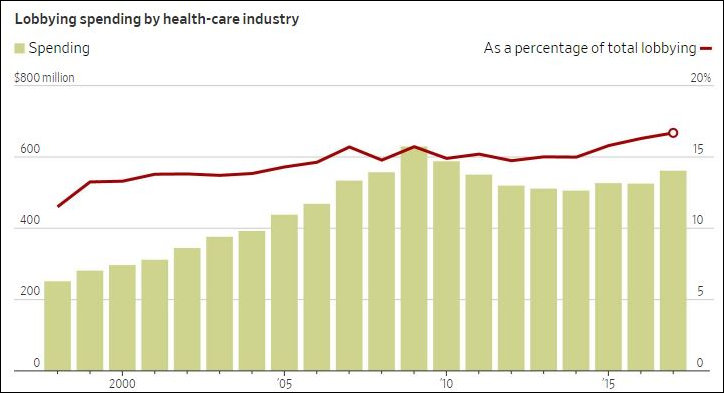

How have hospitals done it? In part by working the political system to rig the rules in their favor — whether through Certificate of Public Need (COPN) regulations at the state level or inserting rules in the Affordable Care Act that effectively banned physicians from competing with hospitals by restricting outpatient clinics. Health care companies have more than doubled their lobbying spending (adjusted for inflation) since 1998. They also have increased their share of total lobbying expenditures by all industries.

These numbers are all national in scope, and they undoubtedly reflect significant variation by state. But they are entirely consistent with what I have seen and blogged about in Virginia. Where the data allows and I have time, I will try to document trends for the Old Dominion.

Leave a Reply

You must be logged in to post a comment.