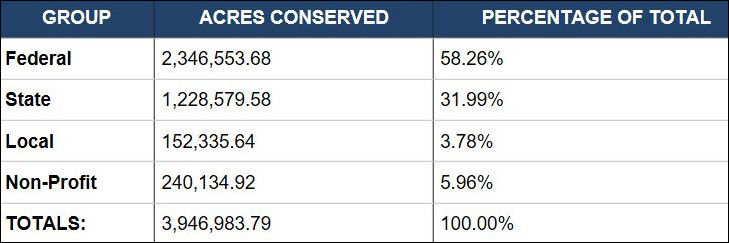

Virginia Conservation Land Statistics. Table credit: Department of Conservation and Recreation

Through tax credits for easements, land acquisitions for parks, and other means, the Commonwealth spends millions of dollars every year to conserve land. Under a new policy adopted by the Northam administration, the state will focus resources on safeguarding land with the highest conservation value.

This new strategy will rely upon a “data-driven process” devised by the Department of Conservation and Recreation (DCR) to rank conservation value. The “scientific analysis” will show where the Commonwealth can get the most conservation value for the buck.

“I believe that we need a land conservation strategy that is focused and targeted toward making measurable progress on our natural resource goals, from restoration of the Chesapeake Bay to providing resilience against sea level rise and other impacts of climate change,” said Governor Ralph Northam in a press release.

The administration said it first will prioritize permanent protection of the top 2% of lands with the highest conservation value and aim for protecting the top 10% within the next ten years. Priorities will include: “protecting watersheds and local water quality, securing and recovering wildlife populations and habitats, making sure agriculture and forestry are viable and sustainable, steering development away from vulnerable and disaster-prone areas, providing access to the outdoors, and preserving sites that represent the history of all Virginians.”

The DCR website “Virginia Conservation Lands Database” page notes that of Virginia’s 25.27 million-acre land area, more than 4 million acres, or 16%, has some form of protection. The main vehicle for preserving lands at present is the land preservation tax credit for up to 40% of the value of donated land or conservation easements. Taxpayers were able to use up to $20,000 per year in 2015, 2016, and 2017, and $50,000 per year in subsequent years.

Bacon’s bottom line: This makes total sense. Indeed, I recall having advocated a priority-setting process at some point in the past. If the state is going to hand out tax credits, which are the functional equivalent of budget expenditures, it should optimize the public value of the easements. It’s astonishing to me that it has taken so long to develop a methodology for ranking the easements, but I’m glad it has finally happened. Kudos to the Northam administration for bringing the program to fruition.