The Earned Income Tax Credit (EITC) proposal that Virginia Democrats are pushing for passage in the 2019 General Assembly is being sold as a major financial boon for the middle class, but is it?

“Our working families making $54,000 a year or less are not going to see a big benefit from these federal tax changes,” Governor Ralph Northam told legislators on December 18. “Those are the Virginians who already see a disproportionate part of their paychecks go to taxes. They deserve to keep more of their paychecks.”

Northam is off by more than $25,000. Using the simple EITC Refund Calculator on the website of Commonwealth Institute for Fiscal Analysis, the EITC’s strongest proponent, it becomes clear the EITC grants will mainly go to taxpayers earning $25,000 or less, and the rhetoric about middle class families is misleading. For taxpayers earning more than $25,000 the benefit from his proposal disappears quickly.

You can find several examples here. Or go to the website and try your own examples. You quickly begin to understand how the EITC works. It’s a useful tool.

The federal Earned Income Tax Credit is a complicated formula based on income and family size, and on federal side any amount above the tax owed becomes a cash payment to the taxpayer. The state EITC amount is 20 percent of the federal amount but produces no cash payment once the state tax liability is satisfied. Northam wants to change than and start writing checks for the balance. The payments will total $206 million in 2020, he said.

“That’s why I proposed earlier this year that we make the Earned Income Tax Credit fully refundable. This work credit—which we already have—goes to our working, middle-class Virginians like our teachers and first responders,” Northam said. The bottom line is that statement is not true because the salaries those workers earn will be too high for a grant.

Taxpayers earning up to and even over $50,000 can (and already do) qualify for a state EITC credit, which reduces or eliminates their state income tax payments, but incomes that high will not qualify for the proposed refund payments. The break point for a couple with two children is approximately $30,000 in income and for single person with two children is approximately $26,000 in income. Above that income, people would not receive a check from Governor Northam’s proposal, but rather would benefit from a higher standard deduction.

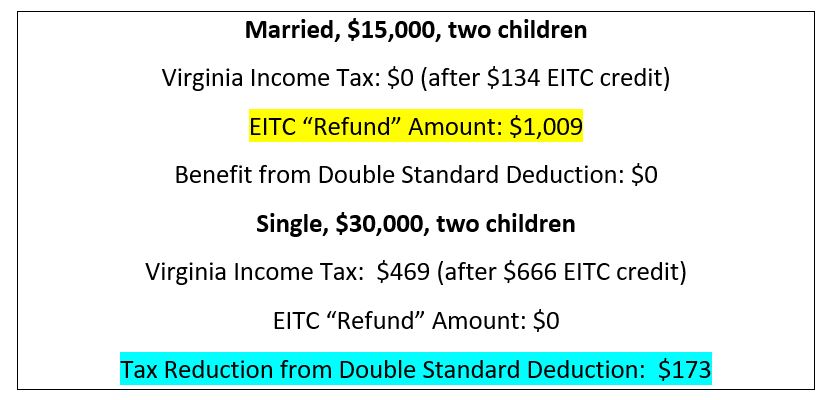

For a single parent with two children earning $15,000, the Virginia EITC cash grant would be substantial, $812. The amount is even larger for a married couple earning $15,000, who receive a check for a $1,009 balance after their tax bill was eliminated. (The payments are made after tax returns are filed, in the same manner as a refund, but of course these are dollars beyond what they paid in withholding taxes. It is not really a refund.)

But a single parent with two children earning $30,000 would receive no benefit from Northam’s proposal, and would still owe $469 in state income tax. That person would instead benefit from any increase in the standard deduction. A couple with two children and that same income (and that might be two persons earning under $10 an hour) receive no EITC refund and still owe a modest $4 in state income tax.

These examples are all from using the Commonwealth Institute’s own calculation tool, which also shows how the EITC reduces taxes at incomes in the $30-50,000 range but does not eliminate them and thus will not produce a cash payment. People earning at those levels would see a substantial benefit from doubling the standard deduction, $345 in lower taxes for joint filers. Those estimates were added in by me.

To double the standard deduction is the proposal that allows people “to keep more of their paychecks.” That is a tax policy response to the challenge and opportunity created by the windfall tax collections due to federal tax changes. The Commonwealth Institute/Governor Northam proposal is a cash transfer payment to (admittedly struggling) people who already owe no income tax.

Leave a Reply

You must be logged in to post a comment.