Ed Gillespie addresses the GOP convention in Roanoke. Photo credit: Washington Post.

Republican Ed Gillespie has issued a blueprint for tax cuts that could define the terms of debate for Virginia’s 2017 gubernatorial campaign. It is a fiscally credible plan. It offers a well-articulated vision for how to jump-start Virginia’s economy. That’s not to say the plan is unassailable, but it is too big and bold to be ignored. Indeed, Republican rival Corey Stewart rolled out his own tax cut plan just a few hours after Gillespie’s announcement. Democratic candidates likewise will be forced to respond.

There are two parts to the Gillespie plan. The first is an across-the-board cut of 10% to state income tax rates, which the campaign says will put nearly $1,300 per year back into the pockets of an average family of four. Gillespie would phase in the tax cut over a five-year period, paying for it out of an anticipated $3.4 billion in state revenue growth, leaving about 60% of the new revenue to fund core services.

The second part would sunset three anti-business, “job-killing” taxes levied by local governments: the Business and Professional Occupancy License tax (or BPOL), the machinery & tools tax, and the merchants tax. To replace lost revenues, he would allow local governments to utilize alternative revenue streams from an unspecified “menu of options” that will be “collaboratively developed.” One option the menu will not include is a local income tax. Localities would be free to re-enact the business taxes or choose from the options.

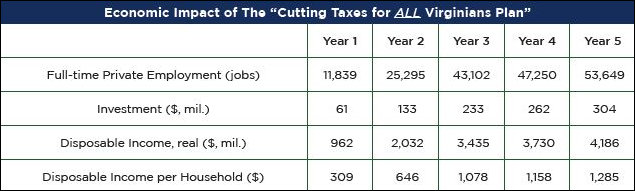

Not only will the tax restructuring boost disposable income for an average household for four when fully phased in, Gillespie claims, it will stimulate $300 million a year in new economic activity, create 50,000 additional private-sector jobs (25% more than would be created otherwise), and help recruit and retain talented workers. These economic estimates are based upon the work of the Thomas Jefferson Institute for Public Policy using economic modeling tools of the Beacon Hill Institute.

The vision. The underlying premise of the plan is that Virginia’s economy is sluggish and needs a jolt to get moving again. Says the plan overview:

Our approach to economic development is antiquated and tired, and Virginia is losing ground to other states. Our economic growth rate has trailed the national average for five straight years. … Virginia’s antiquated ta code was designed in a bygone era and our income tax rates have never been lowered since they were established in 1972. Our tax climate ranking fell to 33rd in 2017, falling behind neighboring states like North Carolina, Tennessee, and West Virginia. Our business rankings are falling, and more people are moving out of Virginia than moving in.

What won’t revive Virginia’s economy, says Gillespie, is picking winners and losers with subsidies, tax breaks and other preferences.

The plan will raise take-home pay for hard-working Virginians squeezed by stagnant wages and higher costs, orient our economy toward start ups and raise ups, entrepreneurs and small businesses, and make Virginia more competitive and attractive to businesses, retirees and veterans. …

Instead of solely focusing our efforts on throwing taxpayer dollars at big corporations and hoping they move to Virginia, this plan is crafted to foster natural, organic economic growth over the long term through a more patient approach that will help start ups, entrepreneurs, and existing small businesses. …

The path to diversifying our economy will be charted by entrepreneurs given greater freedom to invest and innovate. They will identify the new sectors, services and products to flourish in Virginia, not a top-down government approach that picks winners and losers in the marketplace, and too often makes the wrong bets with your tax dollars.

The fiscal math. Gillespie has structured the plan to fend off the inevitable criticism that his plan will crimp funding for critical government services. First, he says, he will offset revenue reductions by eliminating “special interest tax preferences, cutting wasteful spending, and conducting a full review of economic development programs.” Second, he will build in revenue triggers to protect critical investments in education, health care, transportation, public safety, and other core revenues.

Gillespie’s plan is vague about exactly which “special interest tax preferences” he would cut — and he’s vague about the “revenue triggers.” Virginia’s tax code is larded with tax breaks, but the big ones are political popular and eliminating the small ones yield only modest savings. In effect, Gillespie is punting some of the tough political choices until later. As for the tax revenue triggers, presumably, they would limit the tax phase-out in any given year if revenues fail to meet expectations. Undoubtedly, there would be considerable discussion over how sensitive to revenue shortfalls those triggers should be.

Sunsetting the BPOL, M&T and Merchants’ taxes and replacing them with unspecified other taxes would have to be revenue neutral, says the plan. Local governments rely upon an assortment of obscure taxes and fees, but none are likely to replace the lost revenue from the business taxes. Inevitably, staying revenue-neutral will require increases in the mainstay sales taxes, real estate property taxes or personal property taxes — highly transparent levies that hit taxpayers directly in the pocketbook. Local governments might well be happier with the status quo.

Economic impact. The table above summarizes the projected positive economic impact from the tax plan. I find these numbers to be modest and plausible in a $480 billion GDP economy (2015 numbers) with a workforce of more than 4 million. Even if job and income growth doesn’t pan out as optimistically as shown here, the tax plan still stands on its merits. What’s notable is what Ed Gillespie does not do here. He does not engage in “dynamic scoring,” in which the tax cuts pay for themselves through new tax revenues generated by economic growth. Instead, he pays for the tax cuts from revenue growth, assuming it occurs.

What I find appealing about the Gillespie tax plan is its vision to spur “natural, organic growth” rather than dabbling in industrial policy and the picking of winners and losers. In effect, he’s making a moral argument: Tax cuts should benefit everyone; they shouldn’t be doled out to corporate favor-seekers. That, in my mind, is hard to argue with.

Democrats will attack the plan for favoring the “rich,” as indeed it will, given the fact that the rich pay a far greater share of the state income tax than the poor. But the cuts arguably will make the biggest difference to members of the middle class, most of whom fall in the top income bracket. Democrats also will criticize the plan for starving government programs, and indeed it will limit the growth of state spending. Will the plan cripple government programs? We’ll have to wait and see. But life involves trade-offs, and any plan that holds out the prospect of stimulating entrepreneurs, increasing jobs and boosting take-home pay has a lot to recommend it.

Update: Writing in the Washington Post, Norm Leahy says Gillespie’s tax plan can be improved by indexing tax brackets for inflation. The top tax rate kicks in at $17,000. He quotes Del. Jim LeMunyon, R-Chantilly, as saying: “We — Republicans — are taxing the poor, and that’s unconscionable.”