The State Corporation Commission today approved Dominion Energy Virginia’s Integrated Resource Plan, laying out possible investment combinations to keep the power flowing in its territory over the next fifteen years. It also laid out the costs, in excess of $18 billion of investments plus interest plus profit margin to be paid by future customers.

The Commission added the standard caveat that individual decisions to build new generation, energy storage or transmission still must come to the SCC for the regular review. In some cases the judges will have full discretion to approve or reject proposals, but the General Assembly (at Dominion’s suggestion) has also dictated in state law outcomes for several expensive choices.

Fully $6 billion of those future investments were dictated by Senate Bill 966 in 2018, which I have named the Ratepayer Bill Transformation Act.

The approved plan (read the SCC press release here and the full opinion here) is basically the second one provided by the utility, following the SCC’s rejection last year of the initial document. This new document includes a low-cost option, with far less new spending, which the SCC then used as a baseline to highlight the higher cost of the various alternatives.

After filing the amended plan, the utility briefed investors on its capital plans and those plans did not line up with the filed IRP. So the SCC demanded more detail on those, with the results sparking a Bacon’s Rebellion report a few weeks ago (here). All the various possible costs coming to ratepayers are discussed in the opinion.

The order does include a long list of requirements for any future filings, which in Dominion’s case is not far off: they must use the load forecasts prepared by the independent PJM Interconnect regional transmission organization, model the costs of any carbon taxes or regulations, and consider using power purchase agreements for solar generation instead of company-owned projects.

Other media will cover this so the following are just key excerpts from the text:

…As detailed below, the instant IRP, while it meets the minimum legal and regulatory requirements, may significantly understate the costs facing Dominion’s customers.

This understatement of future customer costs is particularly acute given that Dominion’s IRP does not include – appropriately – the multi-billion dollar costs of the statutorily mandated coal-ash removal passed by the 2019 General Assembly and signed by the Governor, which Dominion will collect from customers through a rate adjustment clause (“RAC”), as well as other environmental costs, also eligible for RAC recovery. Further, Dominion is planning to spend several billion dollars (described below) on transmission and distribution projects not included in the 2018 IRP, most if not all of which will also be eligible for RAC recovery.

In sum, we approve Dominion’s IRP as legally sufficient, and we recognize the appropriateness of spending on capital projects when need is proven by factual evidence in actual cases. We do not, however, express approval in this Final Order of the magnitude or specifics of Dominion’s future spending plans, the costs of which will significantly impact millions of residential and business customers in the monthly bills they must pay for power….

The least-cost plan is a valid benchmark against which to gauge the incremental costs of these public policies and investment goals.

As amended as required by the Commission’s December 2018 Order, the Company’s least-cost plan includes substantially fewer new plants to be built and is significantly less expensive for customers. For example, the Company’s amended least-cost plan calls for more than 5,000 fewer megawatts (“MW”) of new resources over 15 years, compared to the originally-filed least-cost plan, a reduction of more than 50 percent. The amended plan is also nearly $8 billion less expensive over 15 years on a net present value (“NPV”) basis, compared to the originally-filed least-cost plan….

The facts show that, compared to the least-cost plan, the various provisions of Senate Bill 966 will cost customers the following on an NPV basis:

- With respect to the Company’s distribution line undergrounding program, called its Strategic Undergrounding Program (“SUP”), the incremental NPV cost is approximately $1.4 billion compared to the least-cost plan.

- With respect to the Company’s plan for electric distribution Grid Transformation projects, the incremental NPV cost is approximately $2.2 billion compared to the least-cost plan.

- Together, the incremental NPV costs of deploying 5,000 MW of solar photovoltaic (“PV”) resources, a 30 MW battery storage pilot and the 12 MW Coastal Virginia Offshore Wind demonstration project, is approximately $1.5 billion compared to the least-cost plan.

- In total, if implemented, the provisions contained in Senate Bill 966 are almost $6 billion more expensive than the least-cost plan on an NPV cost basis.

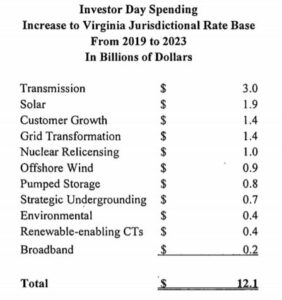

The order then details the $12 billion in investments Dominion touted to investors but did not include in its filing with the SCC.

- Additional investment of $1.5 billion in Company-build solar PV investment not included in any plan contained in the amended 2018 IRP and $3.7 billion more solar investment compared to the least-cost plan.

- Additional investment of $0.8 billion in offshore wind investment not included in any plan contained in the amended 2018 IRP and $1.1 billion more wind investment compared to the least-cost plan.

- An additional $1 billion in investment in a Pumped Storage Facility not included in any plan in the amended 2018 IRP.

- Continued investment in nuclear relicensing in the amount of $1.2 billion.

The investor presentation also had substantially higher figures for some the investments which were described in the IRP, bring up the total. Finally, the SCC pointed to additional expenses not included in either the IRP or investor slides that will eventually be added to customer bills, the largest of which will be the new storage and disposal plans for its piles of coal ash.

The SCC summary of what the General Assembly has done to the regulatory process, and ultimately to consumer costs, should be a campaign issue for the November elections. Most of the legislation involved, however, had broad bipartisan support. It would have to be a challenger vs. incumbent dynamic, with leaders of both parties hoping the issue just goes away.

Leave a Reply

You must be logged in to post a comment.