By Steve Haner

A piece of Republican Governor Glenn Youngkin’s tax package has survived after all, but only the part that increases the sales tax base to collect about $1 billion or so more per year from citizens. Democrats who recently complained that sales tax increases were unfair to the poor are suddenly embracing them.

On Sunday, both the Virginia Senate and the House of Delegates budget committees approved Youngkin’s budget language to impose the sales tax on a host of digital products and services, adding 6% or more to the prices of downloads, streaming services, and online data storage. The full range of newly taxed transactions is not yet clear.

The Senate then increased the gain to the treasury by making sure the new taxes will also cover business-to-business transactions, something the governor sought to exempt and something which is just passed along in higher prices.

The risk of including that tax policy initiative inside Youngkin’s introduced budget bill was obvious from the start, and General Assembly Democrats have now pounced on the opportunity to capture that revenue. The tax increase is now wrapped in with all the state spending for two years, a hard bill to vote against.

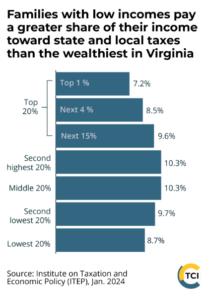

When Youngkin first announced his package in December, its inclusion of higher sales taxes and applying it to more transactions brought complaints from progressives, especially the Commonwealth Institute for Public Policy (see chart above.) Lower income families pay little or no income tax, but the sales tax takes a big bite of their stretched finances, they pointed out (correctly).

Will the same voices now be raised complaining about the impact of these sales tax changes? While the income tax reductions at the lower income level were minor, they were real. The people those progressives claim to worry about were better off under the Governor’s plan than they are with this. That is indisputable.

Remember, the Governor also proposed a modest increase in the Earned Income Tax Credit, which was also yanked out by the House and Senate Democrats.

The Senate’s revenue spreadsheet pegs the tax increase at $380 million in 2025 as the tax kicks in and then $950 million in 2026. The Governor’s initial proposal was a net tax cut, but that prospect is long gone. The Senate and House removed Youngkin’s related tax provisions to lower personal income taxes, which he intended to counterbalance the sales tax changes.

Assuming the budget provisions survive the coming floor votes and the budget conference committee process, Youngkin will then be able to offer amendments to remove the sales tax expansion or to veto it. This game will run into April at least. He will need majority votes in both chambers to impose amendments, but only 34 House or 14 Senate votes to sustain a veto.

The expanded sales tax base joins the two other major tax changes described earlier which are also still alive as the 2024 Assembly enters its final phase. Governor Youngkin had also proposed an increase in the state’s sales tax rate, applied to all taxable purchases. The Democrats rejected that but are instead passing bills to let local governments raise the local sales tax by a similar amount.

Once the local governments take advantage of the local option to raise the tax another 1%, the tax will range from 6.3% to 8% across Virginia, with many localities imposing even higher tax rates on restaurant meals.

And there is still pending legislation to create a new state-funded wage replacement benefit for employees who take time off under the Family and Medical Leave Act. That will be funded by a payroll tax imposed on both employers and employees, with the amount to be determined, but 1% assumed for planning purposes. That is a Senate bill, and the Senate budget showed no costs or revenue but acknowledged the program is coming.

Instead of applying cash it creates a line of credit for the Virginia Employment Commission to begin work on establishing the program, scheduled in the bill to start in January 2026. The fiscal impact statement projects a $1.5 billion initial cost that year, even though employers already providing a wage replacement plan might be exempt.

By killing off the parts of the Youngkin tax plan that would have reduced revenue, and keeping the provision that increased taxes, the legislators on both sides were able to increase their spending plans by about $2 billion over the two- year budget cycle. Most of the extra money is flowing to K-12 public schools and teacher salaries.

Raising the sales tax, state or local, is regressive, hardest on the poor. Expanding the sales tax base is also regressive. And the final pending tax, a payroll tax to fund the FMLA wage replacement benefit, is highly regressive and, unlike the sales tax, impossible to avoid by making fewer purchases.

Adding more injury to insult, the House budget draft also orders the reinstatement of the Regional Greenhouse Gas Initiative, repealed last year under Governor Youngkin. That cap-and-trade regime for electricity comes with an annual carbon tax take of $300 million or more, simply passed directly to consumers. That is yet another regressive tax, but who is counting?

First published this morning by the Thomas Jefferson Institute for Public Policy.

Leave a Reply

You must be logged in to post a comment.