by Dick Hall-Sizemore

Well, Gov. Youngkin has not carried through on his veiled threat to veto the entire budget–yet.

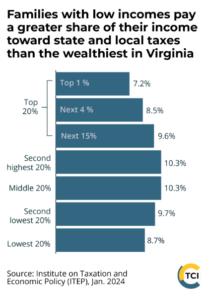

Instead, he has proposed more than 230 amendments that would get rid of the expansion of the sales tax to digital services that the General Assembly passed, along with an extra $1 billion in expenditures that would have been funded with that additional revenue. (Source: Cardinal News.)

To really get a sense of what new spending he is proposing to reduce or eliminate, one would need to laboriously construct a detailed spreadsheet or database. I will wait for the analysis that the staff of the money committees produce. They are likely working on it now.

Two quick observations:

1. Sen. Scott Surovell (D-Fairfax), the Senate Majority leader, in responding to the governor’s actions, relied on a common misconception regarding the Virginia budget. Worrying about packaging amendments that cut revenue with amendments that change spending, he speculated, “You’ll end up having a constitutionally unbalanced budget, which would be illegal.”

Contrary to popular belief, there is nothing in the state constitution that requires the General Assembly to pass a balanced budget. What the constitution does is put the responsibility on the governor to execute a balanced budget. Article 10, Section 7 requires that the “Governor, subject to such criteria as may be established by the General Assembly, shall ensure that no expenses of the Commonwealth be incurred which exceed total revenues on hand and anticipated during a period not to exceed the two years and six months period established by this section of the Constitution.”

It would politically irresponsible and risky for the General Assembly to pass a budget bill that was purposely unbalanced, but there is no constitutional prohibition on its doing so. The constitution does require, however, that the governor clean up whatever mess the legislature may create by doing so. (This is one of the many things that Ric Brown, the long-time deputy director and director of the Dept. of Planning and Budget and Secretary of Finance, taught me.)

2. I am so glad that I am retired and did not have to experience the grueling hours that the DPB staff had to put in over the last few weeks to develop these amendments.

by Jon Baliles

by Jon Baliles