By Steve Haner

A bill likely to produce $1.6 billion or more in local sales tax increases is moving through the General Assembly with enough bipartisan votes to block any veto from the Governor, but differences remain between the House of Delegates and Senate versions.

Both House Bill 805 and Senate Bill 14 would allow all Virginia cities and counties, except for the handful which have already done so, to call a referendum on adding one more penny to the sales tax, a second percentage point dedicated to local school funding.

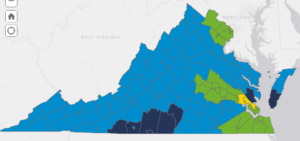

Several localities (dark blue on map) have held and approved such referenda already, authorized by legislation just for them since 2019. All the rest would be authorized to do so. How much money they might reap can be gleaned from this Tax Department report on what they already get from the 1% of the existing share of the tax returned to them for schools. It would be the same or more.

The House version (House Bill 805 as it passed the House) remains narrower in scope than the Senate’s preferred language (House Bill 805 Senate Floor Substitute). But the next step in the legislative ballet is for the full House to vote on that broader Senate version, and it might accept it. Its own version received 69 votes, but only 51 votes are needed to accept the Senate substitute.

The broader Senate version was equally popular, however, with 27 votes. Those are enough votes in either chamber to override any effort by Governor Glenn Youngkin (R) to apply a veto.

The House language limits the use of the money to school construction and renovations and related debt, and any tax approved would expire when that debt is paid, no longer than 20 years after the tax was imposed.

The Senate version is broader: For the purposes of this section, “capital projects” means construction, additions, renovations, including retrofitting and enlarging public school buildings, infrastructure, including technology infrastructure, and site acquisition for public school buildings and facilities.

The Senate also would allow the money to be used for projects that predated the referendum and strikes the requirement that the tax have an expiration date. The word to keep in mind either way is “fungible.” This dedicated school spending indirectly releases other local dollars for other purposes, just as the Lottery did decades ago.

The expiration date included in the House language should provide no comfort, since any future General Assembly can easily take that out in another bill. The Senate version will be the more popular with the local governments and the advocacy groups for education spending.

One of these versions is likely to reach Youngkin, where it will join the budget language that expands the sales tax (state and local) to cover a host of digital products and services, including those purchased by business entities. That enhances the impact of this tax, too.

How can Youngkin complain? The idea of expanding the sales tax to digital items and services was his. The idea of a statewide increase in the sales tax rate was his. He proposed it for the state treasury, not local treasuries, but the taxpayer won’t know where the money is going. The sales tax is attractive to governments because it is largely invisible on day to day retail transactions.

As of right now, Virginia localities collect four different sales tax rates, as seen in the map from the Department of Taxation used for illustration. Most rural localities are collecting a tax of 5.3%. Several urban areas collect an extra amount for regional transportation that brings their rate to 6%. Then the eight smaller localities who already have the extra local “school construction” tax collect 6.3%. Finally, Williamsburg, York and James City County add a local 1% for tourism on top of the base and the regional tax and base, bringing them to a full 7%.

With this new system in place, if every locality adopted it (and it is hard to imagine it failing often) the rates would range from 6.3% to 8% across the Commonwealth.

The official fiscal impact statement from the Tax Department was silent on just how much money this would take from taxpayers, admittedly often from people who do not reside in the localities. “This bill could have an unknown positive revenue impact to any localities that choose to exercise the authority granted by the bill,” it reads. No, it would raise taxes and the amount is known.

Again, all the Tax Department needed to do was provide and tally its own existing report on the current local tax share, which of course is based on the tax collected without the digital items included: Fairfax County, $250 million; Virginia Beach, $94 million; Henrico County, $94 million; Roanoke City, $28 million. Virginia’s sales tax has included this local share since it was first imposed in the 1960s.

The digital items will add much more consumer cost, especially if applied to business-to-business sales. Suddenly those ubiquitous data centers will be major cash cows.

The House should vote early in the week on whether to accept the Senate version or stand firm in demanding its narrower approach and send the issue into a conference committee. Just how much narrower it is won’t matter much to the millions of taxpayers who will see their daily cost of living rise with either bill.

Leave a Reply

You must be logged in to post a comment.