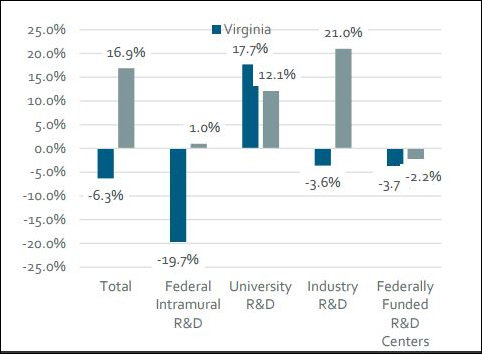

Declining research funding in Virginia, 2010 to 2015. Blue bars=Virginia, gray=national. Source: TECconomy Partners LLC

Virginia universities are slowly gaining ground compared to their peers in R&D, but Virginia businesses are falling behind. Academia and industry need to cultivate closer ties, says strategic consultant Mitch Horowitz.

As a principal of TEConomy Partners LLC, a Bethesda, Md.-based research firm specializing in technology-driven economy development, Mitch Horowitz has had the opportunity to view a lot of technology-leading metropolitan regions close up. And Northern Virginia stands out… but not in a good way.

“I cannot recall a state that has a great technology hub like Northern Virginia that doesn’t have many great research institutes growing up around them,” said Horowitz while briefing the State Council of Higher Education for Virginia yesterday on the challenges in Virginia of linking university and industry R&D to stimulate new business formation and create jobs.

Despite strengths such as a highly educated workforce and access to venture capital, Virginia universities and companies have done a poor job of translating R&D into new business and jobs, said Horowitz.

All told universities, corporations and federal labs in Virginia conducted $10.5 billion in research funding in 2015, ranking it 13th highest in the country. But Virginia’s economy is larger than that of most states, so research as a percentage of GDP ranks the state only 21st nationally in R&D intensity. Even more worrisome, Virginia is losing ground. While research funding grew nationally between 2010 and 2015, it shrank in Virginia. Worst hit was “federal intramural” funding (federal labs). University R&D actually grew faster than the national average, but industry R&D declined 3.6% in Virginia while it surged 21% nationally.

“Decline in industry research and development in Virginia [is] not simply a reflection of strong dependency on federal R&D contracts, but weakness in company funding of R&D leading to the commercialization of new products and process,” stated Horowitz’s PowerPoint presentation.

A root problem is the lack of alignment between university strengths and industry strengths, which reflects the comparatively weak ties between Virginia universities and corporations, Horowitz explained. When Virginia universities do invent something that can be commercialized, Virginia companies typically are not the ones to benefit. Of 137 technology licenses issued by Virginia universities in Fiscal 2017, said Horowitz, 108 went to out-of-state companies.

While Horowitz did not specifically address the geographic imbalance between the location of Virginia’s leading research universities and its technology companies, his observations were entirely consistent with the observation on this blog that Virginia’s leading tech clusters are located in Northern Virginia while its leading research universities are located downstate. George Mason University, the sole public research university based in Northern Virginia, only recently passed the $100 million mark in R&D. The state’s R&D powerhouses, Virginia Tech ($504 million in 2015), the University of Virginia ($373 million), and Virginia Commonwealth University ($219 million) are located in Blacksburg/Roanoke, Charlottesville and Richmond respectively. However, it is worth noting that the rise of the promising Center for Personalized Medicine in Fairfax County under the aegis of the Inova health care system is developing institutional ties with the University of Virginia as well as with GMU and other institutions.

The good news from an economic development perspective, said Horowitz is that Virginia’s research universities have narrowed the gap with their national peers in recent years. The bad news is that all that effort is not translating into much economic activity beyond the research itself.

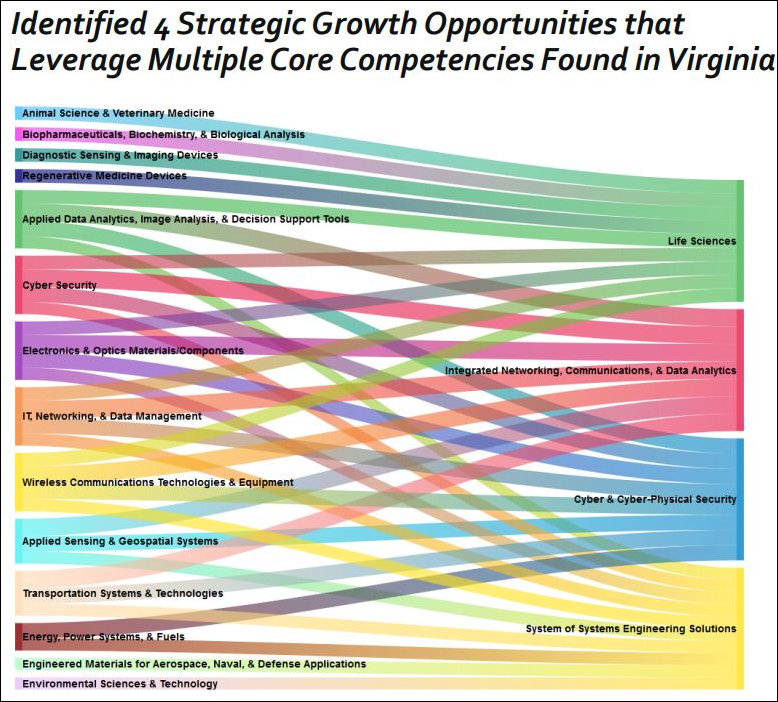

To stimulate local economic growth, says Horowitz, there needs to be a “line of sight,” or alignment between university research strengths and industry expertise. His analysis shows four broad areas where this alignment exists: life sciences; networking, communications, and data analysis; cyber and cyber-physical security; and system of systems engineering solutions.

“You can’t be a winner in every technology area,” says Horowitz. Virginia needs to build on fields in which it enjoys a competitive advantage.

To exploit these advantages, universities and corporations need to bridge the disconnect. Faculty researchers are scientists. While they are expert in the science, they cannot be expected to be experts in potential commercial applications. They need to partner with business. “We need our universities to build relationships with industry,” Horowitz says.

One small step lawmakers have made to bridge the gap is to create the Virginia Research Investment Fund, which dispenses $8 million a year to leverage other research dollars for projects showing a strong potential to create new enterprises and jobs. But the funding is small potatoes compared to the R&D commitment made by leading technology states. Massachusetts is investing $1 billion of public dollars to build its life-sciences sector. Texas has invested multimillions in its innovation ecosystems.

SCHEV board member Tom Slater called Horowitz’s report a “wake up call that’s desperately needed.”

“It’s a call to action,” said Gene Lockhart, another SCHEV board member. “I think there’s a lot of kidding ourselves, a lot of complacency.”

“This kind of effort lifts all boats,” said SCHEV Chair Heywood Fralin. But, he opined, “none of this is free.”