About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Jeanine’s Memes

- Bacon Meme of the Week

- A Rejoinder on the TJ “Fall”

- Greedy Cities and Speeding Ticket Chicanery

- TJ High School Falls From 1st to 14th Place

- Freebees Aren’t Free

- Extensive Plagiarism Alleged for UVA PhD Dissertation

- Some Rural Localities Hit With Big Jump in Local Composite Index

- The Budget Do-Over: A Game of Chicken?

- Jason Miyares–Judicial Activist?

- State Legislatures Control Budgets — Virginia’s More Than Most

- Jeanine’s Memes

- Bacon Meme of the Week

- Ready for Taxes on Netflix, NFL Sunday Ticket?

- Keffiyehs, Yarmulkes and “Belonging” at UVA

A Rejoinder on the TJ “Fall”

Before folks got carried away with sarcasm and “I told you so,” it would have been best to examine a few facts regarding the ranking by U.S. News and World Report of the Thomas Jefferson School for Science and Technology (TJ):

- The ranking fell to fifth last year. The data for that ranking pre-dated the change in the admission process for TJ;

- The changes in the admissions process were adopted in 2020 and were first effective for the class entering in the fall of 2021. Those students would be juniors this year.

Next, it is worthwhile to examine the criteria used by U.S. News:

- College readiness (30 percent)– proportion of a school’s 12th graders who took and earned a qualifying score on Advanced Placement (AP) or International Baccalaureate (IB) exams in the 2021-2022 academic year;

- College curriculum breadth (10 percent)—percentage of a school’s 2021-2022 12th graders who took, and the percentage who earned qualifying scores on, multiple AP or IB exams;

- State assessment proficiency (20 percent)–standardized tests measuring student proficiency in subjects related to mathematics, reading and science. Data was “based on 2021-2022 state assessment data” (Emphasis added);

- State assessment performance (20 percent)—This score is calculated based on the total assessment scores compared with what U.S. News predicted for a school with its demographic characteristics in its state. As the magazine explains, “In all 50 states, there is a very significant statistical relationship between the proportion of a student body that is Black, Hispanic and/or from a low-income household – defined as being eligible for free or subsidized school lunch – and a school’s results on state assessments. Schools performing best on this ranking indicator are those whose assessment scores far exceeded U.S. News’ modeled expectations.” This year’s score is based on 2021-2022 data;

- Underserved student performance (10 percent)—“This is a measure assessing learning outcomes only among Black, Hispanic and low-income students.” As with the others, it is based on 201-2022 data;

- Graduation rate (10 percent)—Percentage of students who entered in the 2018-2019 school year who graduated in 2022.

Greedy Cities and Speeding Ticket Chicanery

by Kerry Dougherty

by Kerry Dougherty

Hire more traffic cops. At the very least hire Virginia companies to fleece Virginia drivers.

That’s the advice I have for Chesapeake and Suffolk, where instead of sending cops with radar guns out to catch speeders, they’ve hired out-of-state vendors with cameras.

Worse, according to attorney and former Del. Tim Anderson, who’s filed suit to stop the practice, the cities allow the vendors – did I mention they were out-of-state? – to impersonate cities when collecting fines.

Anderson says the cameras are cropping up all over the commonwealth. He’s handling two local cases pro bono and is seeking reimbursement for all drivers who were ticketed illegally by the vendors pretending to be city officials. If these cases are successful – and it seems clear the cities are violating the state law – he plans to sue in other jurisdictions to halt the process. Continue reading

TJ High School Falls From 1st to 14th Place

Score a big victory for “equity.” The Thomas Jefferson High School for Science and Technology, ranked the top high school in the country by U.S. News & World Report two years ago, has fallen to 14th place, tweets the Coalition for TJ.

TJ had been the center of an admissions controversy after progressives, who found it scandalous that 70% of the school’s students were of Asian ethnic origin, rejiggered its admissions criteria to make it more demographically diverse. The revised policy, which did succeed in increasing the admission of Whites, Blacks, and Hispanics, survived legal challenges that went as far as the U.S. Supreme Court.

But not to worry. By selecting only the highest-achieving kids, TJ had been perpetuating gross inequality with other high schools. Insofar as its standards have been modified and its rankings have tumbled, the inequality gap with peer schools has diminished. Some observers expect TJ’s rankings will fall and the gap to shrink even further as older students admitted under the ancien regime graduate and are replaced by students admitted under the new, more equitable standards. Continue reading

Freebees Aren’t Free

by Kerry Dougherty

I can’t be the only Virginia Beach taxpayer sick of watching my real estate taxes climb every year while the city council wastes money on pricey gimmicks like “free” Tesla rides for residents and visitors to the city.

For two years we’ve picked up the tab for a small fleet of Teslas to be summoned to haul swells and drunks around the oceanfront.

The first year, the misnamed “Freebee” program cost taxpayers $500,000. Last year the project cost $1.3 million. According to city officials, 52% of riders who were too cheap to call a cab or Uber were visitors, while 48% were locals suffering from the same freeloading mentality.

Notice a pattern?

Thankfully, City Manager Patrick Duhaney left this free-market-tampering boondoggle out of this year’s proposed city budget, although some of the Beach’s tax-and-spend knuckleheads are lobbying to put it back. Continue reading

Posted in Business and Economy, Government Finance, Politics, Transportation

Tagged Kerry Dougherty

Extensive Plagiarism Alleged for UVA PhD Dissertation

by James A. Bacon

Natalie J. Perry, who now leads the Diversity, Equity & Inclusion program at UCLA, plagiarized long passages in her PhD dissertation at UVA, allege Luke Rosiak and Christopher F. Rufo in The Daily Wire.

In describing the plagiarism in Perry’s dissertation, “Faculty Perceptions of Diversity at a Highly Selective Research-Intensive University,” Rosiak and Rufo write:

An analysis of the paper found it ridden with the worst sort of plagiarism, reproducing large swaths of text directly from several other authors, without citations. The scale of the plagiarism suggests that Perry lacks both ethics and competence and raises questions about academic programs that push DEI.

Perry’s dissertation lifted passages from ten other papers. In key portions of her text, she copied almost every paragraph from other sources without attribution. She fails even to mention at least four of the ten plagiarized papers anywhere in her dissertation.

The article says Perry earned her PhD in 2014. Her official biography states that she holds a degree in “higher education” from UVA. The School of Education and Human Development website indicates that the school offers a PhD in Higher Education.

“A legitimate academic field never would have found this dissertation plausible,” Rosiak and Rufo write. Speaking of UVA, Harvard, and UCLA Medical School, they add, “These institutions have dramatically lowered expectations for favored groups and pushed a cohort of ‘scholars’ through the system without enforcing basic standards of academic integrity.” Continue reading

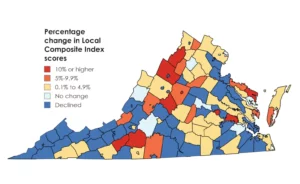

Some Rural Localities Hit With Big Jump in Local Composite Index

Credit: Cardinal News

by Dick Hall-Sizemore

For all those readers who complain that Northern Virginia gets screwed by state funding formulas, Dwight Yancey of Cardinal News has provided an eye-opening rejoinder. Many rural counties have been hit disproportionately hard by the new calculations for the local composite index used to determine the local share of the costs of basic aid for schools.

The main driver in these increases has been significant increases in the total value of real estate in those counties. Many of them have become havens for folks leaving urban areas for the rural countryside, either for their primary or secondary homes. In Franklin County, burgeoning property values around Smith Mountain Lake have driven up the county’s total real property values 39 percent over the past two years, although almost half the students live in poverty. In Nelson County, the situation is much the same with properties in Wintergreen and spillover from Albemarle County driving up the county’s total property values. In Charles City County, where 64 percent of the students live in official poverty, folks buying up riverfront property have driven up the total property values by 24 percent.

The result of these changes is that the state now considers Charles City County as having a greater ability to pay for its schools that Northern Virginia localities, including Loudoun County, the wealthiest locality in the state and one of the wealthiest in the nation. In fact, 22 localities are rated as having a greater ability to pay than Loudoun and most of them are rural.

Yancey provides nice maps to illustrate his analysis.

At some point, the state—governor and legislature—will have to quit delaying and tackle the hard job of revising how the state funds local schools.

The Budget Do-Over: A Game of Chicken?

by Jock Yellott

by Jock Yellott

Speaking off-the-cuff at a Charlottesville/Albemarle Bar Association lunch on April 18, 2024, Senator Creigh Deeds offered some pointed remarks about Governor Youngkin.

The Governor and the General Assembly had just the day before agreed to scrap the budget and the Governor’s proposed amendments and start over from scratch in May, averting a crisis.

Youngkin’s more than 200 proposed budget amendments are evidence of a CEO mentality, Deeds observed. Compared to other governors the Senator has worked with, this one seems disengaged from the political process.

Senator Deeds told his lawyer colleagues he anticipates that in May the General Assembly will vote essentially the same budget.

Consider the implications of that.

To me as an outsider it had looked like the politicos starting over in a spirit of cooperation, this time with more realistic expectations. I was not alone in this: Steve Haner hoped they’ll “finally sit down like adults and negotiate the budget.”

Maybe we were naïve. Continue reading

Jason Miyares–Judicial Activist?

Jason Miyares

by Dick Hall-Sizemore

Jason Miyares has struck out again.

Miyares, Virginia’s Attorney General, keeps asking the Virginia Supreme Court to interpret a statute, based not on how it is actually written, but based on what the General Assembly “intended.” The court’s response is that its function is to ask “not what the legislature intended to enact, but what is the meaning of that which it did enact. We must determine the legislative intent by what the statute says and not by what we think it should have said.”

At issue is the expansion of earned sentence credits for offenders in state prisons enacted by the 2020 General Assembly. This legislation and its implementation has had a convoluted history, which I described in an earlier post. In summary, the maximum number of sentence credits an offender can earn was increased from 4.5 days per 30 days served to 15 days per 30 days served. The legislation listed a large number of exceptions to the expansion. Among the offenses exempted from the expansion were Class 1 felonies (capital murder) and “any violation” of Sec. 18.1-32 (first degree murder).

The aspect of the legislation that Miyares keeps running up against is the omission of inchoate offenses in the list of exceptions. In legal terms, an inchoate crime is “a type of crime that is committed by taking a punishable step towards the commission of another crime. The three basic inchoate offenses are attempt, solicitation, and conspiracy.” Continue reading

Posted in Courts and law, Crime, Corrections and Law Enforcement

Tagged Dick Hall-Sizemore

State Legislatures Control Budgets — Virginia’s More Than Most

Virginia General Assembly Building (new)

by David J. Toscano

For over a month, Virginia’s legislature and governor have been embroiled in a “two scorpions in a bottle” fight over the new biennial budget, which must be passed by June 30, 2024, to fund the government. Last Wednesday, each of them loosened the cork in the carafe. After Assembly-initiated discussions with the governor, Virginia leaders showed, for one moment at least, how the commonwealth operates differently from Washington, D.C. Rather than force Youngkin to take the political hit from vetoing the first Virginia budget in recent history, the House of Delegates used an unusual procedural move, and killed it themselves. All sides committed to producing a new budget and to return on May 15 to pass it. As Churchill once said, “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Budget battles in the commonwealth are not unusual, but this one has been unique, both in the number of changes Republican Gov. Glenn Youngkin proposed to the bipartisan spending plan, and in the rhetoric that has accompanied the process. Youngkin called the bill a “backward budget” and traveled the state on this theme. Legislators fired back, did their own tour, and likened Youngkin’s actions to “what spoiled brats do when they don’t get what they want.”

Last Wednesday, both sides returned to Richmond for the “reconvened” or “veto” session. The governor had vetoed a record number of bills, including measures to protect reproductive rights and enhance gun safety. Since overriding a veto requires a two-thirds vote, the governor was successful with every veto.

The fight over the budget bill is different. Youngkin, like governors in 44 states and unlike our U.S. President, has the power to “line-item veto” specific provisions in the budget. His targets were thought to be a tax on digital services he originally proposed and language that requires the commonwealth to rejoin the Regional Greenhouse Gas Initiative (RGGI). But he abandoned this approach when legislators shrewdly drafted these provisions to make a line-item veto legally problematic.

It does not matter whether you are a Republican or Democratic governor; legislative power is clear in the budget process. Several years ago, Governor McAuliffe learned how crafty legislative budget writing can frustrate key executive goals. The governor hoped to expand Medicaid through the budget, but Republican leadership was resistant, and explicitly included language in the budget to prevent it. McAuliffe attempted to line-item veto that provision, only to have House Republican leadership opine that the Governor had no such constitutional or statutory power to do so. When it comes to the budget, legislators enjoy proclaiming “governors propose; the legislature disposes.” Continue reading

Ready for Taxes on Netflix, NFL Sunday Ticket?

After a month of unproductive political theater, Virginia’s leaders will finally sit down like adults and negotiate the budget. Better late than never. The message is “everything is back on the table,” which leaves the door wide open for the tax increase central to the Democrat’s demands. That deserves a quick no.

At this point, Virginians do not pay sales tax on their Netflix, Disney, or sports streaming package subscriptions. That is what they want to tax now. If you just paid an online vendor to file a tax return, next year a sales tax of up to 6 or 7% will be added to that bill. Likewise, any annual subscription for Microsoft Office or One Drive storage, or for an internet security system, will be taxed. Continue reading

Posted in Business and Economy, General Assembly, Government Finance, Taxes

Tagged Stephen D. Haner

Keffiyehs, Yarmulkes and “Belonging” at UVA

by James A. Bacon

by James A. Bacon

It’s “Palestinian Liberation Week” at the University of Virginia this week, and the Students for Justice in Palestine have organized loads of activities for antizionists, culminating with a “Die-In for Gaza” Friday.

“Wear your keffiyeh,” urges UVA’s Students for Justice in Palestine on its Instagram page. Keffiyehs are traditional Arab scarfs, which students wear to signal their solidarity with Palestinians seeking to combat “settler colonialism” in Israel.

Meanwhile, Jewish students have stopped wearing yarmulkes, Stars of David or other ornamentation that would identify them as Jews.

What does that dichotomy say about the sense of “belonging” — the holy grail of the Ryan administration — experienced by Arabs and Jews respectively at UVA? Continue reading