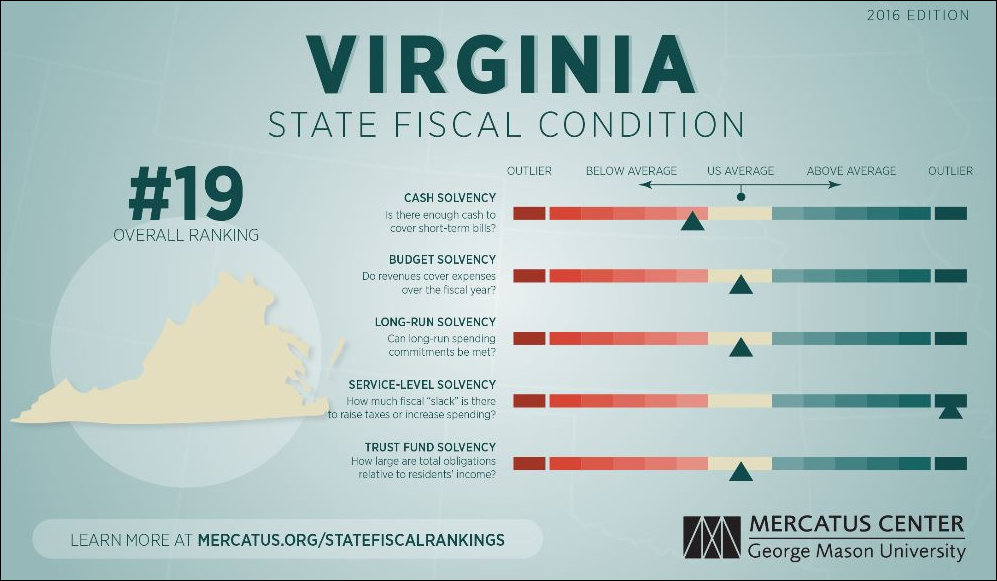

Virginia’s state finances are nothing to brag about, according to data contained in the Mercatus Center’s 2016 edition of “Ranking the States by Fiscal Condition.” The Old Dominion gets below average scores for cash solvency (cash on hand to pay short-term bills), and middle-of-the-road scores for budget solvency and long-run solvency. The state scores above average in trust fund solvency (pension funds and long-term debt), and 5th best in service-level solvency (the ability to raise taxes and increase spending without damaging the economy). Summarizes the Virginia state profile:

Total liabilities are 30 percent of total assets. Total debt is $6.86 billion. Unfunded pension liabilities are $87.66 billion, and other postemployment benefits (OPEB) are $5.19 billion. These three liabilities are equal to 24 percent of total state personal income.

Virginians tend to think that the state’s fiscal condition is fine as long as the Commonwealth maintains a AAA bond rating. Mercatus, which admittedly is funded by the Koch brothers but has no particular ax to grind against Virginia, suggests otherwise.

— JAB