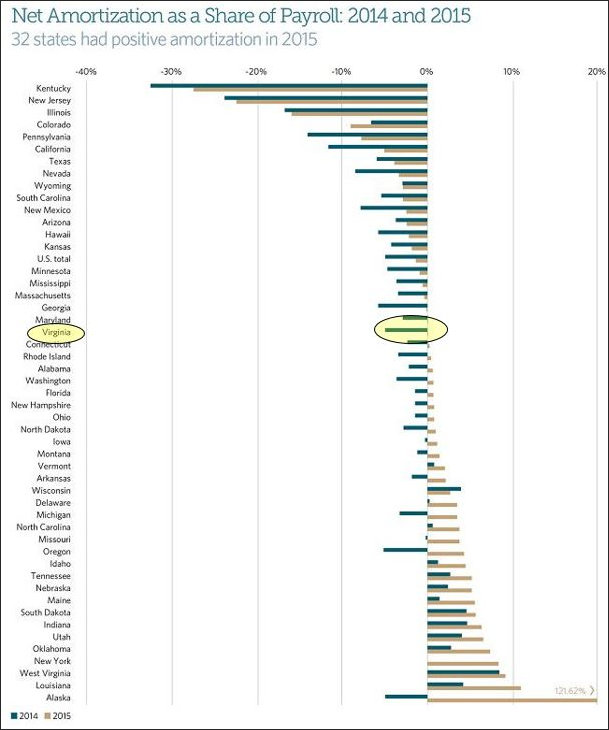

Graphic credit: Pew Charitable Trusts

Another year of tepid economic growth and another year of no progress on Virginia pension liabilities.

Nationally, the gap between liabilities and assets for state pension systems grew 17% in fiscal 2015, reaching $1.1 trillion, according to an annual survey by the Pew Charitable Trusts. Under-performing investments was the biggest driver, accounting for $125 billion of the gap. But even if investment performance had lived up to expectations, the national gap would have increased $30 billion anyway.

Virginia, which prides itself on its AAA bond rating, is hardly an example of fiscal rectitude compared to other states when it comes to funding its state and local pensions. On the one hand, the Virginia Retirement System (VRS) assumes a modest 7% compounded growth rate for its investment portfolio, while state pension plans on average assume a 7.6% annual return. Virginia’s conservative assumption protects it against the downside risk of disappointing investment returns.

On the other hand, Virginia has not been injecting as much money into the pension as needed. Pew has constructed a measure — net amortization — that tracks whether public pension contributions would have been sufficient to reduce unfunded liabilities had portfolio returns met investment assumptions that year. Explains Pew: “Plans that consistently fall short of this benchmark can expect to see the gap between the liability for promised benefits and available funds grow over time.”

According to Pew’s calculations, Virginia needs to contribute $2.5 billion a year. In 2015, the state did meet that goal — actually, it exceeded the goal by 1%. But 2015 followed a dismal shortfall (visible in the chart above) in 2014.

Virginia’s “funded ratio” was 75% in 2015, about the same as the previous year. That is marginally better than the 72% for the funded ratio of the nation as a whole. Of course, that national figure is skewed by the horrendously low ratios of Kentucky, Illinois and New Jersey, which are more or less destined by the iron law of mathematics to become the next Puerto Rico.

Virginia needs to do better. At the current level of state contributions, the VRS is at the mercy of the markets to perform as expected. If we’re lucky and maintain contributions, things will work out. If not, we’re in for a world of hurt.