by James A. Bacon

The Commonwealth Institute has peered into Virginia’s fiscal future and doesn’t like what it sees. The state faces another $500 million budget gap next year, and a $300 million gap the year after that, meaning that the prospects of restoring cuts to education, health care and public safety are bleak.

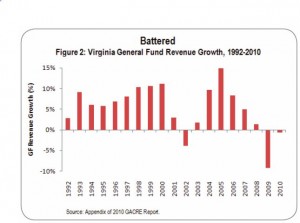

Although tax revenues are recovering, they remain below pre-recession levels, write Sara Okos, Laura Goren, and Michael Cassidy in “In the Red: Early Warnings About Virginia’s Fiscal Outlook.” (Click chart for more legible image.) Meanwhile, prolonged joblessness and poverty require more spending on social services such as food stamps, Medicaid and Temporary Assistance for Needy Families (TANF).

Not only is the economic recovery anemic, the state has significant obligations like replenishing the Rainy Day Fund, repaying the Virginia Retirement System funds it borrowed, and repaying the federal government for unemployment-insurance money it borrowed. Also, funds from the federal stimulus package (the American Recovery and Reinvestment Act) will have expired. Write the authors:

Inadequate revenue growth, coupled with the loss of Recovery Act funds, and increasing other demands on state resources will likely place Virginia on red alert unless action is taken. This could hinder much-needed investments and innovation in public education, health care, public safety, and economic and workforce development.

I share the Commonwealth Institute that Virginia’s conviction that the fiscal situation looks dire, and I believe the think tank deserves credit for bringing the issue to the public’s attention in a more authoritative way than I have been able to do. However, I do take issue with conclusions it draws from its fiscal analysis.

The Institute contends that state and local spending cuts and accompanying layoff of 6,000 employees have “impeded” the economic recovery. Not so. Given the reality that state and local governments must balance their budgets, the only alternative to layoffs would have been increasing taxes. Higher taxes would have killed jobs. Moreover, higher taxes kill private-sector jobs, not public jobs. As some commentators on this blog need reminding, private-sector jobs are more valuable fiscally than public-sector jobs because private-sector employers pay taxes — property taxes, BPOL taxes and corporate income taxes — that governments do not. Offsetting the loss of private-sector jobs with public jobs is a sure-fire way to erode the tax base.

Likewise, the Institute argues that a “cuts-only approach” to balancing the budget will hurt economic recovery. Maybe, but it would hurt less than raising taxes a like amount. The fact is, Virginia is in a fiscal jam and there is no easy way out. Instead of adopting a strategy of spending more money to meet core responsibilities, we should prioritize spending on programs that offer the greatest economic, fiscal and social return on investment.