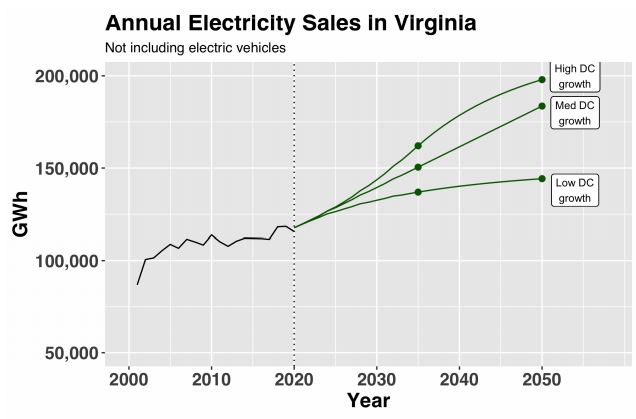

Boom times ahead for electricity. Electricity demand in Virginia will grow 30%, give or take, over the next 15 years as more energy-consuming data centers are built and more Virginians drive electric vehicles, writes Bill Shobe, a University of Virginia professor who supports the transition to a net-zero-carbon electric grid, in a new report. Electricity use could grow by more than 78% by 2050, the state’s deadline for achieving net zero. The increase will occur despite gains in energy efficiency that have flattened electricity demand growth in recent years.

Boom times ahead for electricity. Electricity demand in Virginia will grow 30%, give or take, over the next 15 years as more energy-consuming data centers are built and more Virginians drive electric vehicles, writes Bill Shobe, a University of Virginia professor who supports the transition to a net-zero-carbon electric grid, in a new report. Electricity use could grow by more than 78% by 2050, the state’s deadline for achieving net zero. The increase will occur despite gains in energy efficiency that have flattened electricity demand growth in recent years.

Where will all that power come from?

Relicensing the nukes. Dominion Energy’s four nuclear units at the Surry and North Anna power stations produce about one-third of the utility’s electricity. The units, originally designed to last 40 years, are licensed to operate another 20 years. Dominion is seeking regulatory approval to extend the licenses yet another 20 years. The Nuclear Regulatory Commission staff has recommended granting that approval for the two Surry units. But some environmentalists are opposed. Continue reading

by Emilio Jaksetic

by Emilio Jaksetic