Sidney Gunst built Innsbrook as a state-of-the-art suburban office park in the 1980s but says he would do it very differently today.

Article published in June issue of Henrico Monthly magazine:

By James A. Bacon Jr.

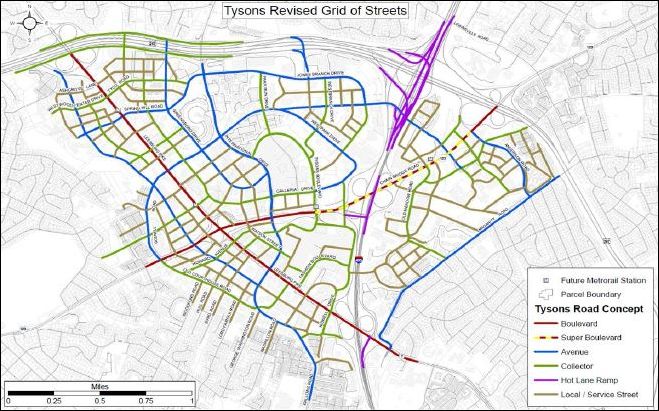

In September 2010, the Henrico County Board of Supervisors put its stamp of approval on a plan to transform the county’s largest office park, the Innsbrook Corporate Center. The idea behind the plan, called Innsbrook Next, was to convert a smattering of office buildings surrounded by parking lots and connected by winding, unwalkable roads into Henrico’s de facto downtown. Planners envisioned millions of square feet of mixed-use development: office towers, parking garages and apartment buildings with stores and restaurants on the ground floors.

Not only would Innsbrook Next breathe new life into Henrico’s largest employment center – between 15,000 to 25,000 people work there, depending on whom you talk to – it represented a sea change in planning policy for the county. Having filled up with traditional, low-density suburban development, the affluent, western half of the county had nowhere to grow but up. To accommodate more growth and more jobs, Henrico had to begin urbanizing. Innsbrook Next would concentrate much of the expected growth into a district that would cause minimal disruption to established neighborhoods.

Nearly five years later, little has happened. A partnership of Markel Corp. and Highwoods Properties submitted a plan to develop the first phase of Innsbrook Next with 2.2 million square feet of mixed-use buildings. The county granted the needed zoning approvals, but the developers backed off. Dominion Virginia Power, a major property owner, submitted plans to convert overflow parking into a townhouse complex. But when county staff balked at aspects of the proposal, Dominion withdrew the project.

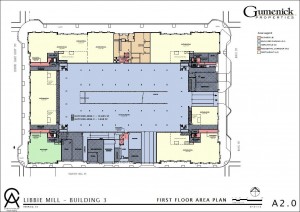

Then, earlier this year, the Dixon Hughes Goodman CPA firm announced the relocation of its headquarters office from Innsbrook to downtown Richmond. A prominent reason given was to make it easier to recruit talented young employees looking for urban amenities. Soon after, insurance firm Rutherfoord said it would consolidate offices, including its Innsbrook headquarters, in the new Libbie Mill-Midtown project at West Broad Street and Staples Mill Road, which had gotten the jump on Innsbrook in building what urban planners call “walkable urbanism.”

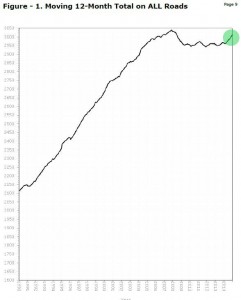

Across the country, suburban office parks are having a tough time. Built mainly in the 1970s, ’80s and ’90s, their age is showing. The buildings have lost the sheen of newness. Mechanical systems are wearing out, and maintenance costs are rising. And most challenging of all, young people prefer to work in urban settings where they can walk to restaurants, galleries, music and entertainment. For decades, downtown areas hemorrhaged tenants as companies decamped for the suburbs. Now the reverse is happening: Some businesses are moving back to the city.

Innsbrook property owners see clearly where the market is heading. Henrico County government leaders do too. Innsbrook needs to transition to a walkable, urban community, almost everyone agrees, in order to remain competitive. The question is whether Henrico is equipped to oversee the transition and whether the planning department has the tools to accomplish it. There is considerable grumbling from developers that county officials are stifling investment by interpreting zoning rules too tightly and squeezing developers too hard on infrastructure costs.

“Why is Innsbrook not developing at the pace that was envisioned?” asks Sidney Gunst, the entrepreneur who built Innsbrook in the 1980s and now maintains a role in the project as a partner in the shopping center near the park’s entrance on Broad Street and as a member of the property owners association. “The bureaucracy is bogging it down, discouraging innovation.” He doesn’t blame individual planners, but he thinks the county’s urban mixed use zoning designation, the planning department’s primary tool for encouraging new urbanism, is flawed; the code is designed for a project built from scratch, not for a project like Innsbrook Next that must incorporate existing buildings. “It’s a bad system,” he says.

“Henrico has an opportunity to be one of the premier addresses [in Virginia] if they would take the shackles off and be creative,” says architect Burrell Saunders, chief executive of Saunders + Crouse who led the Innsbrook Next design. “The question is, do they want to get on board and compete or do they want to watch time pass?”

But Henrico officials are generally bullish. They see Innsbrook Next as a great plan and say they’re simply ensuring that developers stick to it rather than take expedient shortcuts during a soft economy. After peaking around 30 percent during the worst of the recession, vacancy rates at Innsbrook have fallen to less than 6 percent, says County Manager John Vithoulkas. Businesses are expanding, soaking up existing real estate as pressure mounts to build new office buildings. “While you don’t see activity occurring now,” he says, “we have a sense … that something is ultimately going to happen.”

Planning Director Joe Emerson does not see the loss of Dixon Hughes Goodman and Rutherfoord as consequential. Office parks always experience churn, he says. “You’ll always see people move around” as companies’ office needs change or they seek better deals. Innsbrook has tremendous competitive assets, he says, and businesses will continue locating there.

The Markel-Highwoods project could start the ball rolling. Highwoods is marketing the land aggressively. “We’ve been in contact with multiple, high-end apartment developers as well as a wide variety of potential office customers,” says Walton Makepeace, vice president in charge of Highwoods’ Richmond operations. “We’re always canvassing for office tenants. We’d love to start with a pre-lease with a six- or eight-story building with structured parking.”

Once that strategic piece falls into place, Emerson predicts, Innsbrook’s transformation will take off. The Markel-Highwoods project would create a nucleus of grid streets for smaller property owners to plug into. “Once that moves forward, everything moves forward.” Continue reading.