by James A. Bacon

by James A. Bacon

As President of the University of Virginia between 1904 and 1931, Edwin Anderson Alderman led Thomas Jefferson’s university into the 20th century. A self-proclaimed “progressive” of the Woodrow Wilson stamp, he advocated higher taxes to support public education, admitted the first women into UVA graduate programs, boosted enrollment and faculty hiring, established the university’s endowment, reformed governance and gave UVA its modern organizational structure. Most memorably to Wahoos of the current era, he built a state-of-the-art facility, named Alderman Library in his honor, to further the pursuit of knowledge.

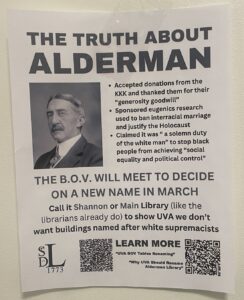

Like many other “progressives” of the era, Alderman also promoted the science (now known to be a pseudo-science) of eugenics, and he held racist views that have been roundly rejected in the 21st century.

A movement has burgeoned at UVA to remove Alderman’s name from the library. The Ryan administration was poised in December to ask for Board of Visitors approval to take that step by renaming the newly-renovated facility after former President Edgar Shannon. The administration withdrew the proposal after determining it did not have a majority vote. But Team Ryan could resurrect the name change at the February/March meeting of the Board, as suggested in the flier seen above. Continue reading

by James A. Bacon

by James A. Bacon by James A. Bacon

by James A. Bacon

by James A. Bacon

by James A. Bacon by James A. Bacon

by James A. Bacon