by James A. Bacon

by James A. Bacon

“The New Geography of Jobs” is arguably the most important book about urban economics published in 2012. Author Enrico Moretti, an Italian-born economics professor at Berkeley, analyzes the great divergence occurring between metropolitan regions in the United States. While much of his narrative about the “innovation” sector as the key driver in regional growth will be familiar to readers of Richard Florida, Moretti provides a valuable counter-balance to Florida’s theories about the creative class.

Just as Florida ascribes remarkable wealth-creating properties to the “creative class,” Moretti puts the innovation sector — referring primarily to high-tech industry clusters — at the center of his analysis. While Florida suggests that members of the creative class gravitate to metropolitan areas that offer a particular set of attitudes (openness, tolerance) and amenities (urban cafe lifestyle, street arts scene), Moretti argues that the economic logic of labor markets are the driving factor.

To Moretti, metropolitan regions are labor pools. The labor that really matters in a knowledge economy is college-educated labor. And what matters even more than generic college-educated labor is labor with technology-related competencies in demand by the corporations that create innovative products and services. “In the world of innovation,” Moretti writes, “productivity and creativity can outweigh labor and real estate costs.”

Thus, a region like San Francisco/San Jose can have outrageous costs of living and doing business yet tech businesses migrate there because that’s where the talent is. And talent moves there because that’s where the jobs are. By doing a better job of matching employers with workers, the productivity-enhancing advantages of “thick” labor markets like Silicon Valley’s more than compensate for the region’s higher costs.

There are two other critical benefits to industry clustering, Moretti writes. Innovation clusters attract investment capital, which funds and nurtures business start-ups. And clusters have what he calls almost “magical” spillover effects. “New ideas are rarely born in a vacuum. Research shows that social interactions among creative workers tend to generate learning opportunities that enhance innovation and productivity. This flow and diffusion of knowledge represents a crucial third advantage for workers and firms that locate within an innovation cluster.”

Thus, regions with strong knowledge clusters tend to grow, attracting both corporations and employees. Regions with weak knowledge clusters tend to remain weak. A third class of cities, which are caught in between, have uncertain futures.

The great public policy question for wanna-be growth centers is how to jump-start an innovation cluster. Broadly speaking, regions have followed two types of approaches. One is a demand-side approach, attracting employers with the hope that workers will follow. The other is the supply-side approach, improving a city’s amenities to lure talented workers in the hope that corporations will come. Following (and often misinterpreting) the theories of Richard Florida, many regions have invested public resources in a futile effort to make themselves “cool” and attract the creative class.

Moretti demolishes that reasoning: “It is certainly true that cities that have built a solid economic base in the innovation sector are often lively, interesting, and culturally open-minded. However, it is important to distinguish cause from effect. The history of successful innovation clusters suggests that in many cases, cities became attractive because they succeeded in building a solid economic base, not vice versa.”

Seattle, for instance, was a dump before Microsoft landed there and created a thick labor market for Amazon.com and a swarm of technology start-ups. Now the region is the epitome of cool. Conversely, Berlin may be the coolest city in Europe from the perspective of artistic creativity, Moretti argues. But technologically, it ranks low on the innovation index, and its income is lower than many other German cities.

What, then, can regions do? Building world-class universities is no panacea. For every Stanford/Silicon Valley, there’s a Johns Hopkins/Baltimore. How about a “big push” industrial policy — targeting a growth industry with public investment? Such approaches might be successful, he contends, but they are very expensive and very risky. Governments chase fads; they are not good at picking winners and losers. How about investing in schools and universities to create home-grown human capital? Great idea, except in the absence of local innovation clusters, the talent will move away. Regions subsidize the development of someone else’s workforce.

At times, Moretti sounds as if the rise of innovation clusters is a matter of serendipity, beyond the ken of government policy wonks to manipulate. Who could have predicted the rise of Microsoft? Who could have predicted its transformative effect on Seattle? One of the few tangible policy proposals he advances is to reform immigration policy to encourage well-educated foreigners (not unlike himself) to settle in the United States. They contribute disproportionately to wealth creation. Of course, they, too, tend to migrate to the nation’s main innovation centers.

Bacon’s bottom line: Other than to replicate Seattle by giving rise to a Microsoft-scale success story — in other words, by getting lucky — there is no simple answer. I distrust industrial policy of picking industries, whether conducted at the national level or the regional level. And the pseudo-Creative Class approach of investing scarce public resources in urban amenities that attract young, educated workers is equally problematic unless corporations can be recruited or businesses launched to hire them.

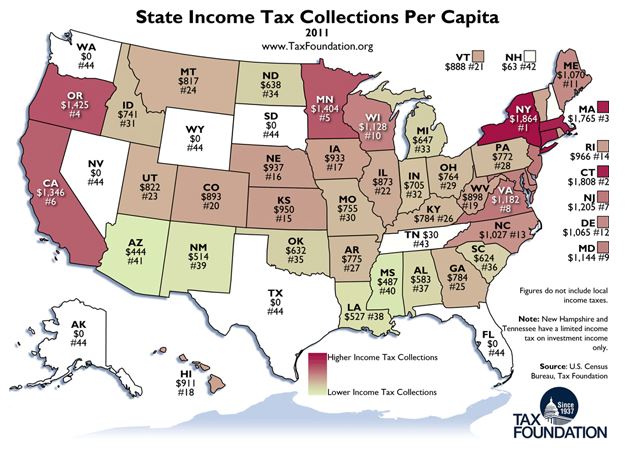

My inclination is to stick with the basics. Government should focus on a few things and do them well. Here in Virginia, and throughout American, that means reforming key broken institutions — K-12, higher ed, health care, transportation and land use — while keeping taxes as low as practicable and the business climate as hospitable as possible. I do think there is a role for making regions attractive to the creative class but those initiatives are best left to the civic realm. In sum, regional success is like personal success — the harder you work, the luckier you get.