The last time the United States had a serious conversation about deficit spending and the accumulating national debt was in 2010 with the publication of the Simpson-Bowles study. (That’s about the same time I wrote Boomergeddon, predicting that the United States had 20 to 30 years before the fiscal wheels fell off the bus.) After the usual tut-tutting, and Republicans blaming Democrats, and Democrats blaming Republicans, nothing was done. Indeed, in the following era of artificially low interest rates that made deficit spending seem painless, Congress, successive presidents, and the media ignored the issue and deficits ballooned.

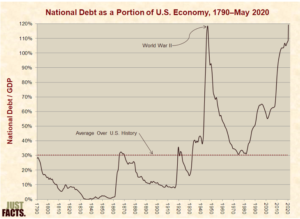

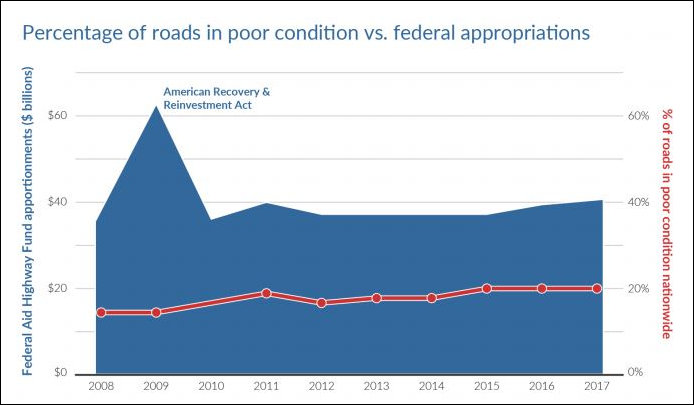

Now the national debt exceeds $34 trillion, the debt-to-GDP ratio exceeds 100%, the structural budget deficit is running between $1 trillion and $2 trillion annually, and it will be only a decade before the Social Security Trust fund runs out and sparks a fiscal/political crisis. Political polarization is even worse today than it was during the Obama presidency. Democrats and Republicans accuse one another of sabotaging democracy, and trust in our institutions has reached an all-time low. It’s as if the captain and the executive officer of the Titanic were fighting for control of the vessel, rolling on the deck trying to gouge each others’ eyes out, even as its prow dips below the icy waters.

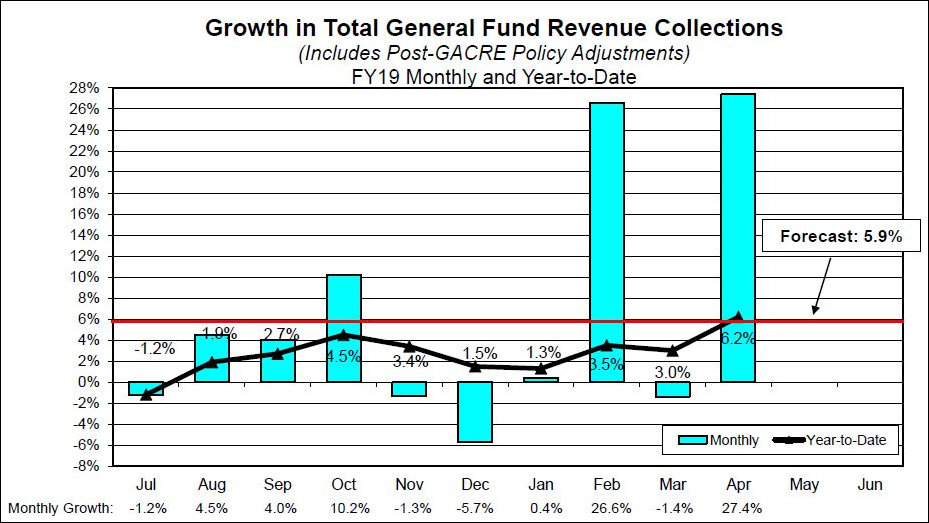

Meanwhile, there is no cognizance in the political rhetoric here in Virginia of the fiscal perils to come. The Commonwealth is required by its state constitution to balance its budget, and the state has managed to retain its AAA bond rating, so we are not as wildly profligate as some other states. I suppose there will be some temporary comfort in the thought that we were not the first to plunge into ungovernable anarchy when the federal government fails. But that comfort likely won’t last long. Continue reading