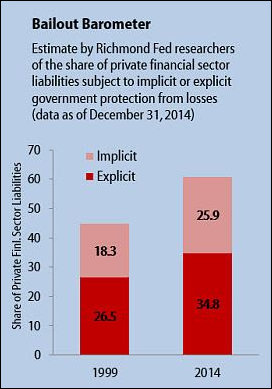

Richmond Fed “Bailout Barometer” — federal backing of total U.S. debt increased another 0.7% in 2015 to reach almost 61%.

Holman W. Jenkins, Jr., at the Wall Street Journal reminds us how countries around the world, including the United States, are doubling down on debt to stave off recession:

The Richmond Fed’s “bailout barometer” shows that, since the 2008 crisis, 61% of all liabilities in the U.S. financial system are now implicitly or explicitly guaranteed by government, up from 45% in 1999.

Citigroup estimates that the top 20 advanced industrial economies, in addition to their enormous, recognized public debts, also face unrecorded additional debts of $78 trillion for their unfunded pension systems.

Six years after a crisis caused by excessive borrowing, McKinsey estimates that even visible global debt has increased by $57 trillion, while in the U.S., Europe, Japan and China growth to pay back these liabilities has been slowing or absent.

No one likes recessions but they serve a useful purpose — they wring bad investments out of the economy and reallocate resources to more productive uses. But that’s not much consolation to a laid off Intel employee in the U.S. or a laid off cement-plant worker in China. So, politicians and central bankers around the world are doubling down on variations of the same strategy of spending, borrowing and financial repression (driving down interest rates to transfer wealth from savers to debtors) to perpetuate economic growth. When countries start experimenting with negative interest rates, the consequences of which no one can predict, you know that policy makers are desperate.

The global economy is entering a new phase: the end game in which democratic welfare states struggle to maintain massive entitlements in the face of aging populations and slowing economic growth. The United States is not as far down this road as some other countries, but absent major policy changes, deficits and the national debt are heading inexorably higher. Don’t believe me — believe the Congressional Budget Office.

Meanwhile, the four leading contenders for U.S. president are advancing platforms totally disconnected from reality. The cost of Bernie Sanders’ programs, if implemented, would cost $18 trillion over ten years, estimates the Wall Street Journal. Donald Trump’s tax-cut plan would cost $9.5 trillion over 10 years, says the Urban-Brookings Tax Policy Center, while the Ted Cruz tax plan would cost $8.5 trillion, according to the same group. The least fiscally irresponsible candidate, Hillary Clinton, would expand government spending by a mere $1 trillion over ten years, according to the McClatchy news organization

We can argue about the biases of the groups crunching these numbers, but that would miss the point. The odds are overwhelming that the next president of the United State will not be remotely serious about balancing the budget. Liberals argue that bigger spending can be paid for with taxes on the rich with little or no adverse impact on the economy, and conservatives can argue that the “dynamic” effects of tax cuts will stimulate economic growth and bring in more revenue than static models would indicate. Yeah, right.

Hither Virginia? There is little that Virginia can do to buffer its economy from these national and international trends, nor can state and local governments insulate themselves from collapsing tax revenue in the next recession. But they can protect themselves by maintaining AAA bond ratings and putting their public pensions on a sound footing so that when the crunch does come, they will be better positioned to meet long-term obligations without debilitating tax increases.

I am particularly worried about two categories of state-local debt. The first category is university debt backed by revenue from students. The higher ed bubble is unsustainable even during a period of modest economic growth. A recession will leave many institutions destitute, and a Boomergeddon-scale calamity could leave the entire industry in a shambles. A second category is debt taken on for “economic development” projects like sports stadiums, convention centers, golf courses, and other glittering objects that are best paid for by private investors trained in analyzing risk.

You can add a third category of long-term obligation: maintaining transportation services such as Washington-area metro, Virginia Beach light rail, Richmond bus rapid transit, and the like, which will require government subsidies in perpetuity. Could local governments support those services in a severe revenue downturn? Doubtful. Likewise, I am suspicious of toll-backed highway bonds assuming long-term traffic growth even as the evolution to more dense, mixed-use communities scrambles traditional commuting patterns, and as Uber, Lyft, Bridj, transportation-as-a-service enterprises, and self-driving cars seem destined to radically alter Americans’ driving habits.

Nassim Nicholas Taleb writes about building “anti-fragile” enterprises and institutions — entities that are not merely resilient in the face of massive adversity but can thrive in adversity. Virginia can become anti-fragile if state and local governments, in the face of a global economic meltdown, can maintain the ability to provide core government services while other states and metros are falling apart. Talent and capital will migrate to the oases of stability. A handful of states will prosper. Will ours be one of them?