The U.S. territory of Puerto Rico, like several American states, has forged a facsimile of prosperity by borrowing and spending beyond its means. Earlier this year, independent bond-issuing authorities began defaulting on their debt. Investors fear the territory will fail to make payments on General Obligation bonds coming due in May and June.

Not surprisingly, Senate Democrats called for bankruptcy protection for Puerto Rico. Every Democrat in the Senate signed a letter in January, calling for “appropriate restructuring tools” available under bankruptcy law that would allow the territory “to respond to [its] economic and humanitarian crisis.” Virginia Senators John Warner and Tim Kaine signed the letter.

Congressional Republicans have been trying to devise some other means of devising default. One proposal has been to create a “control board,” which, though lacking the broad bankruptcy authority that territorial officials had sought, would facilitate some debt restructuring. (Bearing Drift has an excellent article describing the thinking of Rep. Rob Wittman, R-1st, who serves on the House Committee of Natural Resources, which has oversight of this issue.) Democrats maintain that tough measures usurping local control smack of colonialism.

Congressional Republicans have been trying to devise some other means of devising default. One proposal has been to create a “control board,” which, though lacking the broad bankruptcy authority that territorial officials had sought, would facilitate some debt restructuring. (Bearing Drift has an excellent article describing the thinking of Rep. Rob Wittman, R-1st, who serves on the House Committee of Natural Resources, which has oversight of this issue.) Democrats maintain that tough measures usurping local control smack of colonialism.

All sides agree that there is no easy remedy. Either bond holders get stiffed, rattling municipal markets and creating fallout for the 50 states, or Puerto Rico must adopt draconian policies that will cripple the economy and hurt the poor. There is no happy ending here.

Why should Puerto Rico’s financial woes concern a Virginia-centric blog? Because whatever solution is devised for the territory will set a precedent for future bail-outs and, indeed, could accelerate the coming reckoning with reality of states in terrible fiscal shape like Illinois. Inevitably, there will be calls for more forgiveness in which fiscally disciplined states like Virginia will bail out improvident states.

Michael Thompson, president of the Thomas Jefferson Institute for Public Policy, makes the following observation in his latest column:

Michael Thompson, president of the Thomas Jefferson Institute for Public Policy, makes the following observation in his latest column:

Allowing Puerto Rico the unprecedented power of abridging [municipal] debt will come at a direct cost to Virginia and all the other states that rely on the bond market for financing. Once the market sees that ‘full faith and credit’ protections are faulty, borrowing costs will go up for states in accordance with the increase risk. … Likewise, the value of funds holding this debt, which are found in 401ks and other retirement nest eggs across Virginia and the rest of the country, will be severely shaken.

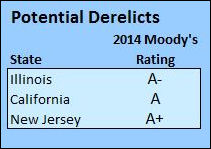

The importance of Thompson’s insight cannot be overstated: Once bond investors realize that the assurances they thought they were guaranteed are rendered null and void by political expediency, they will demand a risk premium on all other municipal debt. That will hurt Virginia, although probably to a lesser degree than states lacking our AAA rating. What the Senate Democrats overlook is that investors will demand the highest risk premium for precisely those states whose finances are in greatest disarray — the blue states of Illinois, New Jersey and California. A higher cost of debt would make Illinois’ currently perilous predicament even worse.

Now, it’s one thing for Congress to take a hard line toward Puerto Rico, a territory that no one quite considers a part of the United States, and a very different thing to take a hard line on Illinois, which has senators and representatives with voting rights in Congress. Should the unimaginable occur and Illinois default on its bonds, bailing out Puerto Rico will create a precedent that will make it harder to deny Illinois, and any other states that might follow it, similar consideration.

The country will immediately polarize between citizens of states that have acted prudently, made hard choices, and husbanded their resources and states that ducked fiscal reforms and borrowed more. Congress will face a terrible decision: whether to bail out the improvident, thus creating a moral hazard for the very behavior that got those states into the fix in the first place, or to hold the line, at the risk of having state governments failing to perform essential responsibilities, as we have seen, for instance, in the Flint, Mich., lead-poisoning crisis.

This is a litmus test issue for me. Having railed against fiscal recklessness for years only to be told by many that I am an alarmist if not an outright right-wing whackjob, I have zero sympathy — no, in this brave new world of negative interest rates, I have negative sympathy — for any Virginia politician who caves on this issue. I will wage relentless blogfare against anyone who buckles. The spenders and borrowers need to get a strong, in-your-face message that states must mend their fiscal their ways because there will be no succor for them in the future. Tough luck, Puerto Rico. But better you than Illinois.