As if the City of Richmond didn’t have enough problems, now tensions are erupting between the executive director, board of trustees, and members of the city pension fund’s investment advisory committee. Based on the account by Michael Martz at the Richmond Times-Dispatch, the rancorous relations between pension director Leo F. Griffin and members of the investment advisory committee might have originated over policy but have now gotten personal.

The underlying issue appears to be over who should control the pension’s investment decisions. For years the investment advisory committee set policy in lieu of hiring a high-priced chief investment officer. But Griffin, who took on his post three years ago, allegedly has been working behind the committee’s back to assume control of rebalancing the system’s investment portfolio and making other investment decisions, while blocking the flow of information to committee members. In effect, Griffin is alleged to be changing the governance model of the pension fund without a serious discussion by the board.

Like most Richmonders, I had never heard of the Richmond Retirement System. I assumed that the Virginia Retirement System ran the city’s pensions. But, no, the city’s $540 million fund is responsible for paying the retirement benefits of nearly 10,000 retired and current city employees.

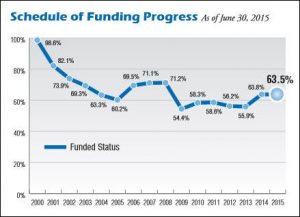

This fracas follows on the heels of a proposal by Richmond Mayor Dwight Jones earlier this week to raise taxes and borrow $580 million over the next ten years to fix the city’s derelict public school buildings and meet other capital needs approaching $1.5 billion. The two sets of issues are linked because, it turns out, city pensions are only 63.5% funded, and the unfunded liability amounts to $310 million. As seen in the “Schedule of Funding Progress,” the city has made only marginal progress during the past seven years of economic expansion to restore the pension to the fully funded position it had in 2000.

This fracas follows on the heels of a proposal by Richmond Mayor Dwight Jones earlier this week to raise taxes and borrow $580 million over the next ten years to fix the city’s derelict public school buildings and meet other capital needs approaching $1.5 billion. The two sets of issues are linked because, it turns out, city pensions are only 63.5% funded, and the unfunded liability amounts to $310 million. As seen in the “Schedule of Funding Progress,” the city has made only marginal progress during the past seven years of economic expansion to restore the pension to the fully funded position it had in 2000.

In reading the pension fund’s 2015 Comprehensive Annual Financial Report, I see that the pension fund could be even more fragile than it appears from those numbers. When calculating its unfunded liabilities, pension managers assume that the fund’s assets will generate an annualized rate of return of 7.5% over the long run. By contrast, the Virginia Retirement System assumes a “discount rate” of only 7.0%. Some pension observers say that, in an era of persistent, near-zero interest rates, the discount rate should be even lower.

The discount rate used by municipal pension funds has political ramifications. A higher rate assumes greater investment returns, which reduces the funds the City of Richmond has to contribute each year to support the pension. But if actual performance falls short, the city will have to increase its annual payout, much as the General Assembly has done in recent years to shore up state pensions.

Fiscally speaking, we live in perilous times. We fantasize that we’ll always be able to muddle along. Then along comes Puerto Rico, which shows how dysfunctional our political system can get when managing long-term debt. Closer to home we can observe the political turmoil created when Illinois and Chicago, a state and city with massive unfunded pension obligations, struggle to avoid becoming the next Puerto Rico.

The City of Richmond is an awesome place and, economically speaking, has more going for it than any time in 30 or 40 years. But weak finances may be its Achilles heel.