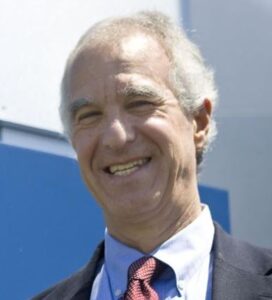

Photo courtesy of Kelly Phillips

by Kerry Dougherty

There’s a reason Gov. Glenn Youngkin’s approval rating in the latest Mason-Dixon Poll perches at a lofty 58 percent in this once-blue state, despite Republicans losing control of the legislature in November’s election.

Youngkin gets it.

On X, he wrote:

“We’re going to fix this, Virginia will always be the best place to live, work, and bake cake pops!”

Like everyone else who heard about Kelly Phillips’ cake pop conflict, the governor immediately saw this for what it was: one more example of government overreach, punishing an enterprising Richmond woman with a small business for no good reason or public benefit.

According to The Virginia Mercury, cake pops are Ms. Phillips’ side hustle. Her day job is as a manager in a financial planning firm. But what began simply as irresistible treats she made for birthday parties and baby showers grew into a little cottage business.

Phillips now sells her gorgeously decorated confections mostly at craft fairs. If Richmond regulators have their way, she’ll have to stop.

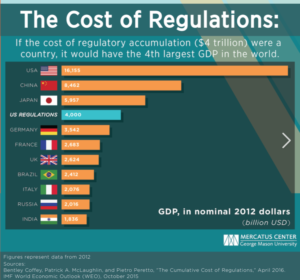

Virginia’s stringent food safety regulations, designed to protect folks from unsanitary practices, make exceptions for small craft bakeries. But ridiculous regs, such as the one that allows these homemade goodies to be sold at farmer’s markets but not craft fairs make absolutely no sense.

“What is the difference between a farmers market and a craft show?” Phillips asked The Mercury.

Gee, I don’t know. A roof? Continue reading