by James A. Bacon

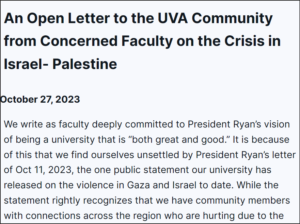

The University of Virginia task forced assigned the job of ensuring that UVa is “welcoming” to all religions includes two faculty members who signed an open letter criticizing UVa President Jim Ryan for failing after the October 7 terrorist rampage afflicted upon Israel to acknowledge the suffering of the Palestinian people.

Ryan denounced Hamas terrorism but declined to take sides in the ongoing conflict between Palestinians and Jews. The task force’s aim, according to the announcement in UVa Today, “will be to understand how Jewish and Muslim students, faculty and staff, as well as those of other religious backgrounds, experience life on Grounds.”

“We want every student, faculty member and staff member to understand that they are a vital part of this place and how profoundly they enrich our common life as we take on that fundamental work of the University,” Ryan said.

The task force is headed by College of Arts & Sciences Dean Christa Acampora. She will be supported by 10 faculty, staff, students, and other members of the UVa community. Christians, Muslims and Jews are all represented. A challenge will be keeping the focus on how Jewish and Muslim students are experiencing UVa without getting infected by the emotional debate over the Israeli-Palestinian conflict that gave rise to the task force. Continue reading

by James A. Bacon

by James A. Bacon by James A. Bacon

by James A. Bacon

by James A. Bacon

by James A. Bacon