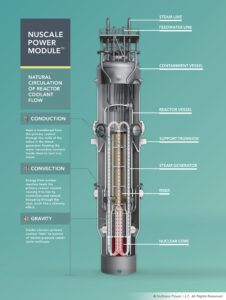

Dominion Energy Virginia insists that its decision to sell a half-interest in the Coastal Virginia Offshore Wind project “won’t impact ratepayers.” The problem is, perhaps it should. Perhaps Dominion is creating additional value for its shareholders that instead should benefit ratepayers. Continue reading

About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Freebees Aren’t Free

- Extensive Plagiarism Alleged for UVA PhD Dissertation

- Some Rural Localities Hit With Big Jump in Local Composite Index

- The Budget Do-Over: A Game of Chicken?

- Jason Miyares–Judicial Activist?

- State Legislatures Control Budgets — Virginia’s More Than Most

- Jeanine’s Memes

- Bacon Meme of the Week

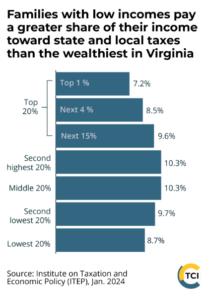

- Ready for Taxes on Netflix, NFL Sunday Ticket?

- Keffiyehs, Yarmulkes and “Belonging” at UVA

- Public School Enrollments Still Declining

- The Incredibly Shrinking Newspaper

- Diamonds Aren’t Forever

- Will Democrats Shut Down State Over Tax Hike?

- Fairfax Spends More, Teaches Less

from the Liberty Unyielding blog

from the Liberty Unyielding blog