Graphic credit: Wall Street Journal

Today’s Wall Street Journal editorial page explores the ramifications of the Federal Reserve’s decision to dial back years of Quantitative Easing and near-zero interest rates. Higher interest rates will translate directly into higher debt payments for the world’s largest debtor, Uncle Sam.

Interest on the debt rose $28 billion for the six months of fiscal 2017. Annualized, that amounts to $56 billion in a budget that is running a $522 billion deficit this year

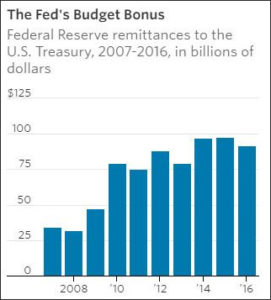

During the era of Quantitative Easing the Fed purchased trillions of dollars of financial assets, the profits on which were remitted back to the U.S. Treasury. That amounted to a gift of between $50 billion and $70 billion or so above typical remittances of the pre-QE era. As the Fed unwinds QE and disposes of its assets, those remittances will decline as well, creating a double-barreled shot to federal budget deficits. Between higher interest payments, lower remittances and the structural imbalance of spending and revenue, increasing federal deficits are on auto-pilot. Not a single additional dollar of spending increases or tax cuts is necessary to push the nation toward fiscal crisis.

The Trump administration has different budgetary priorities than the Obama administration — it wants to increase defense spending while cutting domestic spending — but it appears to be no more serious about attacking deficits than was the Obama administration. Insofar as there seems to be a fiscal policy, it amounts to cutting regulations, reforming the tax structure and protecting American jobs from foreign competition in order to boost economic growth. In theory faster growth will generate a gusher of tax revenue that will more than make up for the tax cuts.

In my humble appraisal, dialing back regulations and reforming the tax code will stimulate economic growth, but not by a miraculous amount. The U.S. economy faces strong headwinds of an aging workforce, stagnant productivity, runaway education and health care costs, a spread of social dysfunction from the lower class to the working class, massively underfunded pensions, and fragile overseas economies. The global economy is more heavily leveraged with consumer, business and government debt than at any time in peace-time history and remains extraordinarily vulnerable to black swan events. Boomergeddon is coming. The only question is whether it takes fifteen years or twenty to get here.

Implications for Virginia. The Old Dominion is more dependent upon federal spending than almost any other, and we have more to lose than most from a federal fiscal and monetary meltdown. We need to diversify our economy, we need to bullet-proof the balance sheets of our state and local government, and we need to re-think how we deliver core government services more cost-effectively. Indeed, we should strive to be not merely resilient in the face of federal budgetary disaster, that is, in a position to survive a Boomergeddon scenario, but to be, in the words of Nassim Nicholas Taleb, “anti-fragile,” that is, in a position to actually thrive amidst a federal fiscal crack-up.

How could Virginia prosper while the rest of the country descends into fiscal anarchy? Simple: by preserving the ability to maintain core government services like roads, education, health care and public safety while other states experience fiscal insolvency and disintegrating services. Corporate capital and human capital will flee to the oases of order and sanity. Think of California during the Great Depression. Think of Switzerland today.

I acknowledge that it’s difficult to act upon projections of what might happen 15, 20 or 25 years from now. Indeed, many will accuse me of gloom-mongering. But I have read enough history and experienced enough history to know how rapidly things can change. Everything is fine… until it’s not. And then we’ll wish we’d heeded the warning signs.