About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Keffiyehs, Yarmulkes and “Belonging” at UVA

- Public School Enrollments Still Declining

- The Incredibly Shrinking Newspaper

- Diamonds Aren’t Forever

- Will Democrats Shut Down State Over Tax Hike?

- Fairfax Spends More, Teaches Less

- Jeanine’s Memes

- Bacon Meme of the Week

- What the School-Discipline Meltdown Looked like in Newport News

- UVA Report Finds No Pay Inequity for Black, Hispanic Profs

- Utilities Will Gamble on Nukes With Your $$$

- Are Nonchalant Adults Responsible For School Shootings?

- Fighting Over the Check at the Green Power Cafe

- Governor Leaves Consistency and Principle Behind

- Jefferson Institute’s Hit List Bills Mostly Gone

Author Archives: James A. Bacon

What Do We Make of the VCU-Qatar Connection?

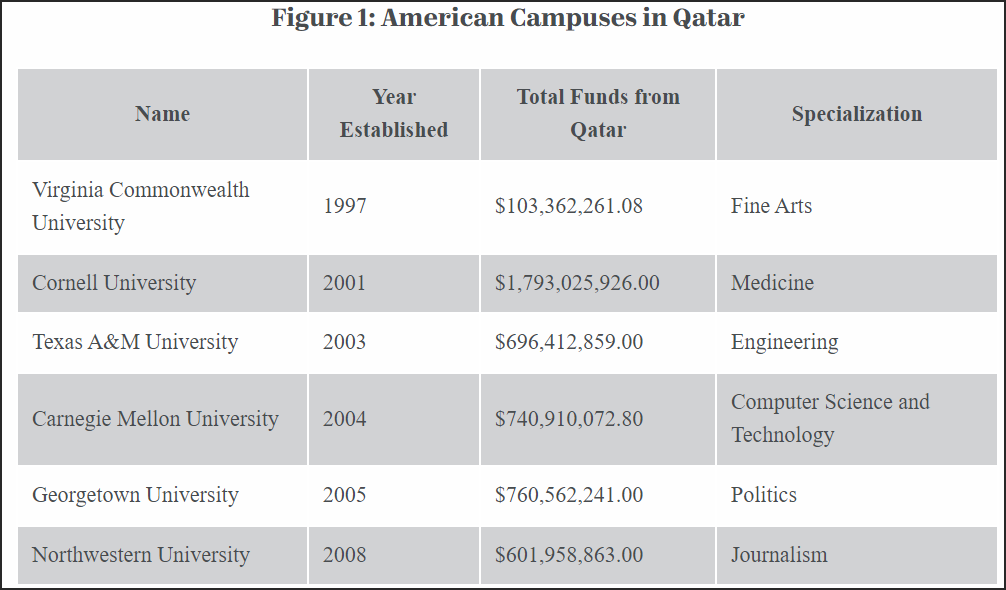

A new report from the National Association of Scholars explores the entanglements between American universities and Qatar, a small state on the Persian Gulf known as the home of the Al Jazeera news network and a haven for Hamas leadership and other assorted radical Islamists. Qatar has emerged as a top foreign funder of American universities, investing more than $4 billion between 2001 and 2021. Virginia Commonwealth University, the first American university to establish an overseas campus in the country, has been one of the biggest beneficiaries, receiving more than $103 million.

University leaders say their Qatari campuses help spread Western values in the conservative Middle Eastern country, which is ruled by an authoritarian, semi-constitutional monarchy, according to the NAS paper. But one might ask the reverse: what influence, if any, does Qatari money exert on VCU? Continue reading

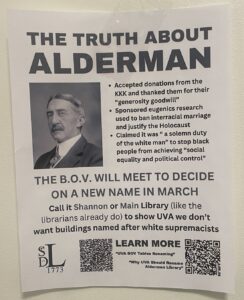

The Purge Comes for Edwin Alderman

by James A. Bacon

by James A. Bacon

As President of the University of Virginia between 1904 and 1931, Edwin Anderson Alderman led Thomas Jefferson’s university into the 20th century. A self-proclaimed “progressive” of the Woodrow Wilson stamp, he advocated higher taxes to support public education, admitted the first women into UVA graduate programs, boosted enrollment and faculty hiring, established the university’s endowment, reformed governance and gave UVA its modern organizational structure. Most memorably to Wahoos of the current era, he built a state-of-the-art facility, named Alderman Library in his honor, to further the pursuit of knowledge.

Like many other “progressives” of the era, Alderman also promoted the science (now known to be a pseudo-science) of eugenics, and he held racist views that have been roundly rejected in the 21st century.

A movement has burgeoned at UVA to remove Alderman’s name from the library. The Ryan administration was poised in December to ask for Board of Visitors approval to take that step by renaming the newly-renovated facility after former President Edgar Shannon. The administration withdrew the proposal after determining it did not have a majority vote. But Team Ryan could resurrect the name change at the February/March meeting of the Board, as suggested in the flier seen above. Continue reading

Posted in Culture wars, Education (higher ed), Virginia history

Tagged James A. Bacon, University of Virginia

Boomergeddon Countdown: Ten Years… Nine…

The last time the United States had a serious conversation about deficit spending and the accumulating national debt was in 2010 with the publication of the Simpson-Bowles study. (That’s about the same time I wrote Boomergeddon, predicting that the United States had 20 to 30 years before the fiscal wheels fell off the bus.) After the usual tut-tutting, and Republicans blaming Democrats, and Democrats blaming Republicans, nothing was done. Indeed, in the following era of artificially low interest rates that made deficit spending seem painless, Congress, successive presidents, and the media ignored the issue and deficits ballooned.

Now the national debt exceeds $34 trillion, the debt-to-GDP ratio exceeds 100%, the structural budget deficit is running between $1 trillion and $2 trillion annually, and it will be only a decade before the Social Security Trust fund runs out and sparks a fiscal/political crisis. Political polarization is even worse today than it was during the Obama presidency. Democrats and Republicans accuse one another of sabotaging democracy, and trust in our institutions has reached an all-time low. It’s as if the captain and the executive officer of the Titanic were fighting for control of the vessel, rolling on the deck trying to gouge each others’ eyes out, even as its prow dips below the icy waters.

Meanwhile, there is no cognizance in the political rhetoric here in Virginia of the fiscal perils to come. The Commonwealth is required by its state constitution to balance its budget, and the state has managed to retain its AAA bond rating, so we are not as wildly profligate as some other states. I suppose there will be some temporary comfort in the thought that we were not the first to plunge into ungovernable anarchy when the federal government fails. But that comfort likely won’t last long. Continue reading

No More Legacy Admissions in Virginia

by James A. Bacon

Bills to ban preferential treatment for relatives of alumni at Virginia’s public universities flew through the 2024 session of the General Assembly in remarkable time. In a legislature marked by intense partisan divisions, companion bills passed subcommittees, committees, and the full Senate and the House of Delegates on unanimous votes. According to the Richmond Times-Dispatch, Governor Glenn Youngkin has indicated he will sign the bill.

“If we’re going to have an even playing field, let’s have an even playing field,” said Democratic Sen. Schuyler VanValkenburg, D-Henrico, who sponsored the Senate bill.

VanValkenburg’s statement presumably alludes to last year’s U.S. Supreme Court ruling restricting preferential treatment in college and university admissions on the basis of race. Many Republicans and conservatives argued that policies should not tilt the playing field for or against members of a particular race or ethnic group. Admissions, they contend, should be based on merit.

In this case, Virginia Republicans appear to be true to their meritocratic principles. Attorney General Jason Miyares was among those backing the ban on legacies. The Times-Dispatch summarized his thinking this way: “Colleges should judge applications based on what a student can control — such as classes, grades and extracurriculars — not the color of their skin or their parents’ school.” Continue reading

Scott Surovell’s End Run Around Jason Miyares

Sen. Scott Surovell

by James A. Bacon

The battle for control of higher-ed institutions in Virginia is boiling over into the state legislature. Senator Scott Surovell, D-Mount Vernon, has submitted a bill, SB 506, that would allow Virginia’s public universities to hire their own legal counsel in place of lawyers answering to the Attorney General.

The bill would give governing boards of every institution authority over the hiring of “outside legal counsel, the oversight and management of any legal counsel, and the appointment of a general counsel to serve as the chief legal officer of the institution.”

Attorney General Jason Miyares

Public universities are classified as state agencies. Like other state agencies, their legal interests are represented by counsel that reports to the Office of Attorney General.

The underlying political conflict is who controls Virginia’s colleges and universities. The issue surfaced last year when former Bowdoin University President Clayton Rose addressed the University of Virginia’s Board of Visitors and suggested that board members owe their primary loyalty to the institution, not their personal agendas. He received pushback from two board members appointed by Governor Glenn Youngkin who argued that the duty of board members is to represent the interests of the Commonwealth of Virginia, not the institution itself. Continue reading

Looking More Like New Jersey Every Day

by James A. Bacon

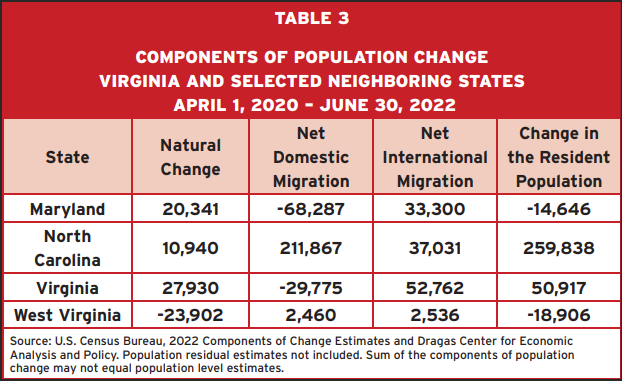

I’ve frequently made the observation that Virginia has been leaking population through domestic migration. However, as recent data published by Old Dominion University’s Strome College of Business make clear, the loss of population through domestic migration is more than offset by net international migration. Between April 1, 2020, and June 30, 2022, Virginia lost nearly 30,000 people through domestic migration, but gained nearly 53,000 through international migration.

That data (shown in the table above) and more can be found in ODU’s 2023 State of the Commonwealth report on Virginia’s economy.

Perhaps the most interesting data tell us the states where people are coming from and the states where Virginians are going to. As can be seen in the tables below, people moving to Virginia in 2021 came mainly from the northeast — New Jersey is at the top of the list — and they’re moving mainly to southern states. Continue reading

The Most Woke Universities in Virginia

by James A. Bacon

Borrowing a methodology from a Harvard computer science prof, Jay Greene and Mike Gonzales with The Heritage Foundation have calculated a wokeness ranking for Virginia’s public universities: the number of times “social justice” appears in a university’s course catalog.

Measured by the absolute number of “social justice” mentions, James Madison University is the most woke (72 references), followed by George Mason University (59), and Virginia Commonwealth University (53).

Some universities offer far more courses than others, however, so Greene and Gonzalez introduce another measure: a ratio of courses that mention “social justice” versus courses that mention “Constitution.” Continue reading

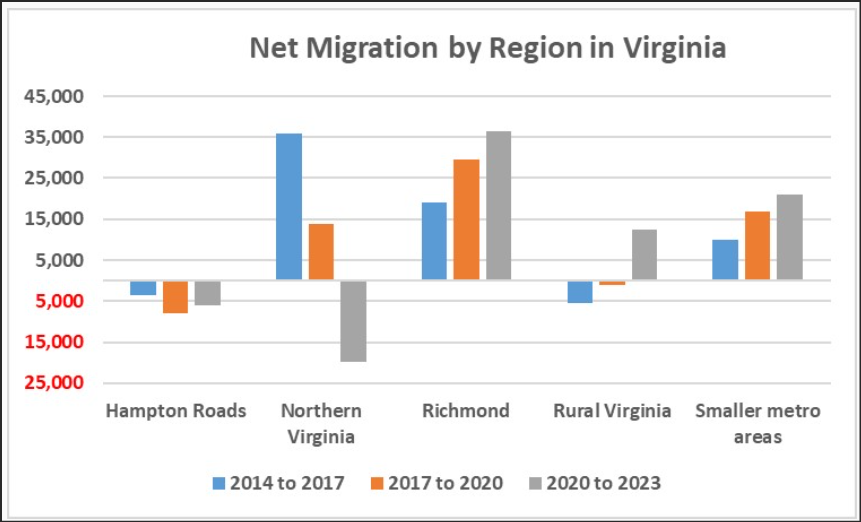

Virginia’s New, Post-Covid Population Growth Reality

by James A. Bacon

Population growth patterns are shifting within Virginia. So far during the current decade, Virginia’s two largest metropolitan areas — Northern Virginia and Hampton Roads — have been losing population due to net migration (more people moving out than moving in). The trend, evident before the Covid epidemic, became more pronounced during and after.

Meanwhile, Richmond has emerged as the state’s new in- migration growth leader. And in an encouraging turnabout, Virginia’s smaller metros (collectively) and rural localities (collectively) have been gaining population through in-migration as well, according to analysis by Hamilton Lombard at the Demographics Research Group of the University of Virginia. Continue reading

What Do You Do If There Are No Statues Left to Tear Down?

Step #1: Reinterpret the Confederate statues;

Step #2: Remove the Confederate statues from the public square;

Step #3: Prevent those who want the statues from having them. Decapitate the statues, melt them down, or desecrate them in art and museum displays.

What’s left? Where else is there to go?

Step #4: Take away tax-exempt status from a prominent organization dedicated to preserving the statues.

SB517 and HB 568 would eliminate the exemption from state recordation taxes for the Virginia Division of the United Daughters of the Confederacy (UDC) as well as the tax exemption for real and personal property owned by the United Daughters of the Confederacy. The House Bill passed the House Finance Committee in a 12 to 10 (presumably party-line) vote. Continue reading