About

Bacon's Rebellion is Virginia's leading politically non-aligned portal for news, opinions and analysis about state, regional and local public policy. Read more about us here.Fund the Rebellion

Shake up the status quo!

Your contributions will be used to pay for faster download speeds and grow readership. Make a one-time donation by credit card or contribute a small sum monthly.

Can't wait until tomorrow for your Bacon's Rebellion fix?

Search Bacon’s Rebellion

Content Categories

Archives

The Jefferson Council: Protecting Thomas Jefferson’s Legacy at the University of Virginia

Want More Unfiltered News?

Check out the Bacon’s Rebellion News Feed, linking to raw and unexpurgated news and commentary from Virginia blogs, governments, trade associations, and advocacy groups.

Submit op-eds

We welcome a broad spectrum of views. If you would like to submit an op-ed for publication in Bacon’s Rebellion, contact editor/publisher Jim Bacon at jabacon[at]baconsrebellion.com (substituting “@” for “at”).

Forgot Your Password?

Shoot me an email and I'll generate a new password for you.-

Recent Posts

- Bacon Meme of the Week

- A Rejoinder on the TJ “Fall”

- Greedy Cities and Speeding Ticket Chicanery

- TJ High School Falls From 1st to 14th Place

- Freebees Aren’t Free

- Extensive Plagiarism Alleged for UVA PhD Dissertation

- Some Rural Localities Hit With Big Jump in Local Composite Index

- The Budget Do-Over: A Game of Chicken?

- Jason Miyares–Judicial Activist?

- State Legislatures Control Budgets — Virginia’s More Than Most

- Jeanine’s Memes

- Bacon Meme of the Week

- Ready for Taxes on Netflix, NFL Sunday Ticket?

- Keffiyehs, Yarmulkes and “Belonging” at UVA

- Public School Enrollments Still Declining

Author Archives: James A. Bacon

Bacon Meme of the Week

Posted in Bacon and Pigs

TJ High School Falls From 1st to 14th Place

Score a big victory for “equity.” The Thomas Jefferson High School for Science and Technology, ranked the top high school in the country by U.S. News & World Report two years ago, has fallen to 14th place, tweets the Coalition for TJ.

TJ had been the center of an admissions controversy after progressives, who found it scandalous that 70% of the school’s students were of Asian ethnic origin, rejiggered its admissions criteria to make it more demographically diverse. The revised policy, which did succeed in increasing the admission of Whites, Blacks, and Hispanics, survived legal challenges that went as far as the U.S. Supreme Court.

But not to worry. By selecting only the highest-achieving kids, TJ had been perpetuating gross inequality with other high schools. Insofar as its standards have been modified and its rankings have tumbled, the inequality gap with peer schools has diminished. Some observers expect TJ’s rankings will fall and the gap to shrink even further as older students admitted under the ancien regime graduate and are replaced by students admitted under the new, more equitable standards. Continue reading

Extensive Plagiarism Alleged for UVA PhD Dissertation

by James A. Bacon

Natalie J. Perry, who now leads the Diversity, Equity & Inclusion program at UCLA, plagiarized long passages in her PhD dissertation at UVA, allege Luke Rosiak and Christopher F. Rufo in The Daily Wire.

In describing the plagiarism in Perry’s dissertation, “Faculty Perceptions of Diversity at a Highly Selective Research-Intensive University,” Rosiak and Rufo write:

An analysis of the paper found it ridden with the worst sort of plagiarism, reproducing large swaths of text directly from several other authors, without citations. The scale of the plagiarism suggests that Perry lacks both ethics and competence and raises questions about academic programs that push DEI.

Perry’s dissertation lifted passages from ten other papers. In key portions of her text, she copied almost every paragraph from other sources without attribution. She fails even to mention at least four of the ten plagiarized papers anywhere in her dissertation.

The article says Perry earned her PhD in 2014. Her official biography states that she holds a degree in “higher education” from UVA. The School of Education and Human Development website indicates that the school offers a PhD in Higher Education.

“A legitimate academic field never would have found this dissertation plausible,” Rosiak and Rufo write. Speaking of UVA, Harvard, and UCLA Medical School, they add, “These institutions have dramatically lowered expectations for favored groups and pushed a cohort of ‘scholars’ through the system without enforcing basic standards of academic integrity.” Continue reading

Keffiyehs, Yarmulkes and “Belonging” at UVA

by James A. Bacon

by James A. Bacon

It’s “Palestinian Liberation Week” at the University of Virginia this week, and the Students for Justice in Palestine have organized loads of activities for antizionists, culminating with a “Die-In for Gaza” Friday.

“Wear your keffiyeh,” urges UVA’s Students for Justice in Palestine on its Instagram page. Keffiyehs are traditional Arab scarfs, which students wear to signal their solidarity with Palestinians seeking to combat “settler colonialism” in Israel.

Meanwhile, Jewish students have stopped wearing yarmulkes, Stars of David or other ornamentation that would identify them as Jews.

What does that dichotomy say about the sense of “belonging” — the holy grail of the Ryan administration — experienced by Arabs and Jews respectively at UVA? Continue reading

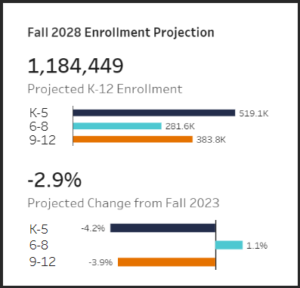

Public School Enrollments Still Declining

Virginia K-12 public school enrollment will decline by nearly 31,000 students, or about 2.9 percent, over the next four years, according to the demographic research group at the Weldon Cooper Center for Public Service at the University of Virginia.

Virginia K-12 public school enrollment will decline by nearly 31,000 students, or about 2.9 percent, over the next four years, according to the demographic research group at the Weldon Cooper Center for Public Service at the University of Virginia.

The fall-off is expected to be sharpest among high school students, which augurs negatively for future enrollment at Virginia’s universities and community colleges.

The Center based its estimates on the number of births in school districts, projecting forward five years to Kindergarten, and then adjusting for later grades by estimated percentages of students advancing to the next grade, school transfers, migration, dropouts, and deaths. Major uncertainties center around the impact of virtual learning and whether the exodus to private schools and home schools during the COVID epidemic will recede. — JAB

What the School-Discipline Meltdown Looked like in Newport News

A special grand jury investigating a six-year-old’s shooting of a teacher at Richneck Elementary School in Newport News has released its report, and the findings are almost as horrifying as the shooting itself.

The grand jury indicted Richneck’s assistant principal Ebony Parker on eight counts of child abuse. It is the first time, suggests The Washington Post, that an administrator has been charged in connection with a school shooting.

While Parker’s inaction was surely inexcusable, the breakdown in safety runs far deeper than the negligence of a single school official. The behavior of Parker and other individuals reflects institutional dysfunction, which in turn reflects deep-rooted attitudes in the educational profession and society at large.

These dysfunctions and attitudes, I suggest, are endemic throughout most of Virginia’s public education system. They are reflected in widespread reports of violence against teachers all around Virginia, especially in school districts where “progressive” ideology is dominant. Abigail Zwerner, victim of the six-year-old’s attack, may be the only Virginia school teacher to have been shot in recent years, but hers is no isolated instance of violence. Continue reading

Posted in Uncategorized

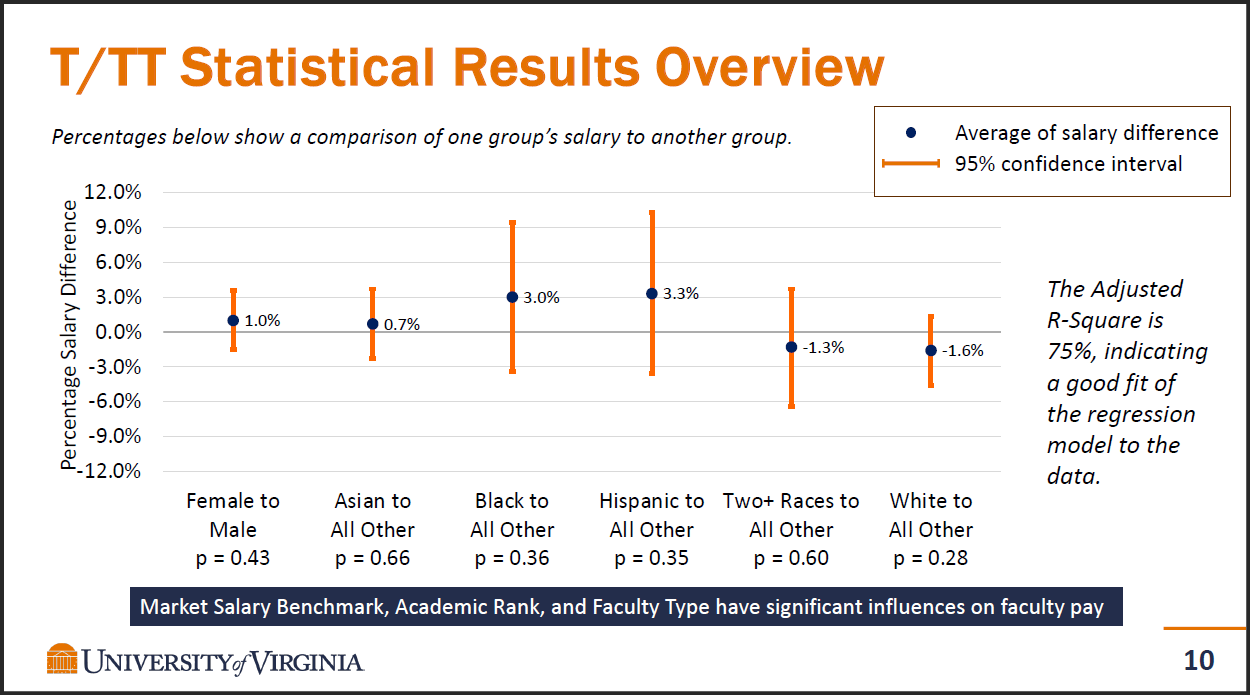

UVA Report Finds No Pay Inequity for Black, Hispanic Profs

Adjusted salary differentials for tenure/tenure track faculty.

by James A. Bacon

The Racial Equity Task Force, a 2020 document that transformed governance at the University of Virginia, listed 12 top priorities for addressing the legacy of historical racism. One was to address “serious challenges to racial equity in staff hiring, wages, retention, promotion, and procurement” by auditing where policies and procedures might be “reinforcing entrenched inequities.”

The report cited no actual evidence of disparities in pay, and the authors did not assert that they existed. In a report that lambasted UVA as “an inaccessible, rich, ‘white’ institution,” pay inequities were just assumed to occur and needed to be documented.

Well, last year the Ryan administration hired the DCI Consulting Group to evaluate “pay equity” for UVA faculty based on gender and race. The results, based on 2022 compensation, were made available to UVA January 5 and, sure enough, pay inequities were found…. for non-tenured Asian-American faculty.

Remarkably, adjusted for their level in the academic hierarchy, seniority and other variables affecting compensation, Black professors who are tenured or on the tenure track were f0und to earn 3% more than their peers, Hispanic professors 3.4% more, and Whites 1.6% less — although DCI did not deem the differences to be “statistically significant.” Continue reading

Posted in DEI, Education (higher ed), Race and Race Relations

Tagged James A. Bacon, University of Virginia

Jewish Parents Decry Double Standards at UVA

by James A. Bacon

A half year after Hamas terrorists assaulted Israel, hostility at the University of Virginia toward Israel and Jews is unrelenting, according to parents of Jewish students there. In collaboration with other parents, Julie Pearl complained in a letter Tuesday to Rector Robert Hardie that a “blatant double standard against Jewish students persists at UVA.”

Pearl’s letter was prompted in part by the administration’s response to a recent incident in which a truck with digital billboards rolled through the University displaying messages critical of Hardie. One screen said, “Rector Robert Hardie won’t confront antisemitism” while another said Hardie is “unfit to lead U.Va.” The administration’s reaction was to criticize the slogans and investigate who was behind the stunt, Pearl said.

Pearl’s letter was prompted in part by the administration’s response to a recent incident in which a truck with digital billboards rolled through the University displaying messages critical of Hardie. One screen said, “Rector Robert Hardie won’t confront antisemitism” while another said Hardie is “unfit to lead U.Va.” The administration’s reaction was to criticize the slogans and investigate who was behind the stunt, Pearl said.

“How does the billboard incident directed at you merit outrage, an immediate statement of condemnation, and investigative action … while the ongoing harassment and intimidation faced by Jewish students receive no such response?” she asked. Continue reading