by James A. Bacon

Virginia’s revenue problems run much deeper than the Great Recession, argues the Commonwealth Institute in a new report, “Frozen in Time: Virginia’s Revenue System Can’t Pull Its Weight.” Chronic revenue shortfalls are the fault of the Old Dominion’s antiquated tax structure.

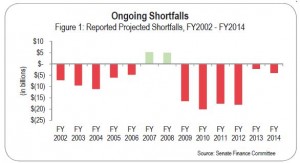

Virginia has grappled with budget shortfalls in 10 of the last 12 years, note authors Sara Okos, Sookyung Oh and Michael Cassidy. Reliance on “deep cuts, one-time budget-balancing tools, and gimmicks” got the state through the recession. But structural problems persist.

The report cites costly tax breaks for favored industries that get “baked into the tax code but are not subject to the same regular scrutiny or evaluation as other types of state spending”; an income tax structure that has not been touched since 1987 despite a market shift in income distribution to higher-income households; and policies that enabled 60% of Virginia corporations to pay no income tax in 2008.

Concludes the report:

Virginia’s general fund revenues have fallen short of the levels needed to fund education, public safety, transportation, health and human services, and other public obligations that contribute to a strong economy for over a decade. And they will continue to do so because a maze of obsolete and narrow policies, set between 25 and nearly 100 years ago – and for the most part not updated since – have Virginia frozen in time. Holding fast to a state tax system that was designed for yesterday’s economy, not the Virginia of today, is starving the needs of our modern state and jeopardizing our ability to create good jobs and ensure a better future for the next generation. It is time for Virginia to engage in a serious conversation about revenue modernization. It is time to talk taxes.

If there is one thing that liberals and conservatives can agree upon, it is that Virginia’s tax code desperately needs an overhaul. It is indeed time to talk taxes. The big question is which reforms to enact.

I would submit the following principles should guide any discussion: (1) We should aspire to create as level a playing field as possible by eliminating special deductions, loopholes and credits; (2) we should seek the broadest possible tax base so as to keep tax rates as low as possible, thus reducing economic distortions and tax-avoidance behavior; (3) we should strive for simplicity and ease of compliance; and (4) we should balance the goal of making the tax system progressive, in which wealthier Virginians pay more than poorer Virginians, with the goal of stimulating economic growth and job creation.

The Commonwealth Institute does not recommend specific policy changes. But in April the Jefferson Institute for Public Policy pitched a proposal for restructuring the tax code that, it argued, would stimulate economic growth. If it’s time to talk taxes, perhaps the Commonwealth Institute and the Thomas Jefferson Institute should sit down and see if they can find common ground.