A new study by the Tax Foundation and KPMG of state business taxes differs from previous studies, which look at average levels of taxation, by examining how state tax structures affect different types of business. The big conclusion from “Location Matters: The State Tax Costs of Doing Business“: Firms experience dramatically different tax rates because their exposure varies to different state and local taxes.

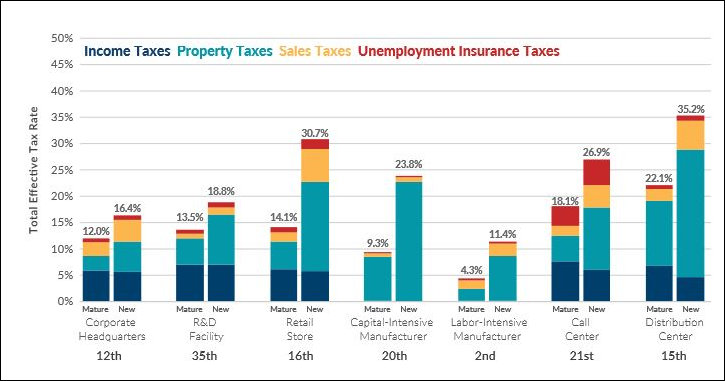

The study’s analysis of Virginia’s tax structure suggests that established companies experience much lower overall tax burdens than new companies. The Old Dominion ranks second best in the country for mature, labor-intensive manufacturing operations but only 35th for R&D facilities.

Bacon’s bottom line: I have frequently decried the lack of entrepreneurial dynamism in Virginia as a root cause for our sluggish economic performance. There may be many reasons for Virginia’s mediocre growth record in recent years but, based upon the data shown in the chart above, one of them is certainly the structure of business taxes.

In every category analyzed, new firms experience higher effective tax rates than mature firms. Just as important, look at the comparative ratings. Virginia ranks No. 2 in the country for mature, labor-intensive manufacturing companies — neither a growth sector, nor a particularly high-paying sector — but only 35th for R&D, the kind of economic activity every state covets. If we wanted to design an economy for the 20th century, not the 21st, we’ve done a pretty good job.

(Hat tip: Larry Gross)