Apco = Appalachian Power Co. DEV = Dominion Energy Virginia. Source: State Corporation Commission.

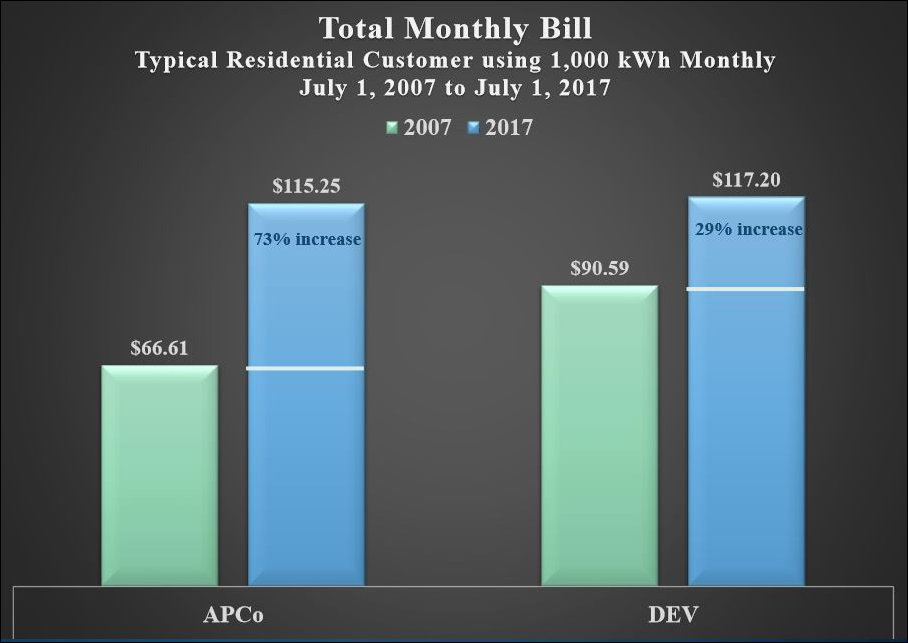

Monthly electric bills for a typical Virginia household (using 1,000 kilowatt hours) increased by $48.64 for Appalachian Power Co. customers over the past 10 years, and $26.61 for Dominion Energy Virginia customers. Those numbers come from a presentation by Kimberly B. Pate, director of the division of utility accounting at the State Corporation Commission, at a hearing last week of the Commission for Electric Utility Regulation.

The cost to Apco of cleaning emissions from its coal-fired power plants, which accounted for three-quarters of its generation in 2007, pushed up electric rates much faster than it did for Dominion, which relied on coal for only 36% of its output. Apco’s rates, which were lower than Dominion’s for decades, are now almost at parity.

For policy geeks, it is helpful to plumb beneath the surface of those numbers to see what forces drove the cost increases. Pate looked at the three categories of rates, which, when combined, create the overall rate: base rates, which encompass mainly operating costs; the fuel rate; and RACs, or rate adjustment clauses that pay for capital projects like new transmission lines or power plants.

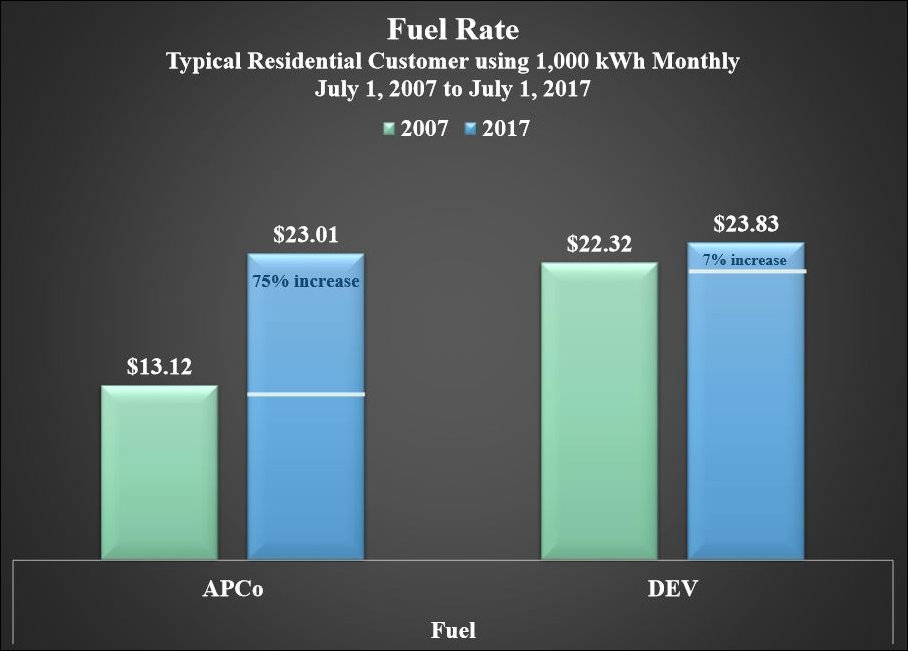

Over the past decade Apco experienced a 75% increase in its fuel rate, as seen above. However, because fuel is a modest portion of the overall cost, that increase added only $9.89 to the typical household’s monthly fuel bill. For Dominion, which benefited from declining natural gas prices over the decade, the rise in fuel prices was modest indeed, only 7%, and it added only $1.51 to customers’ monthly bill.

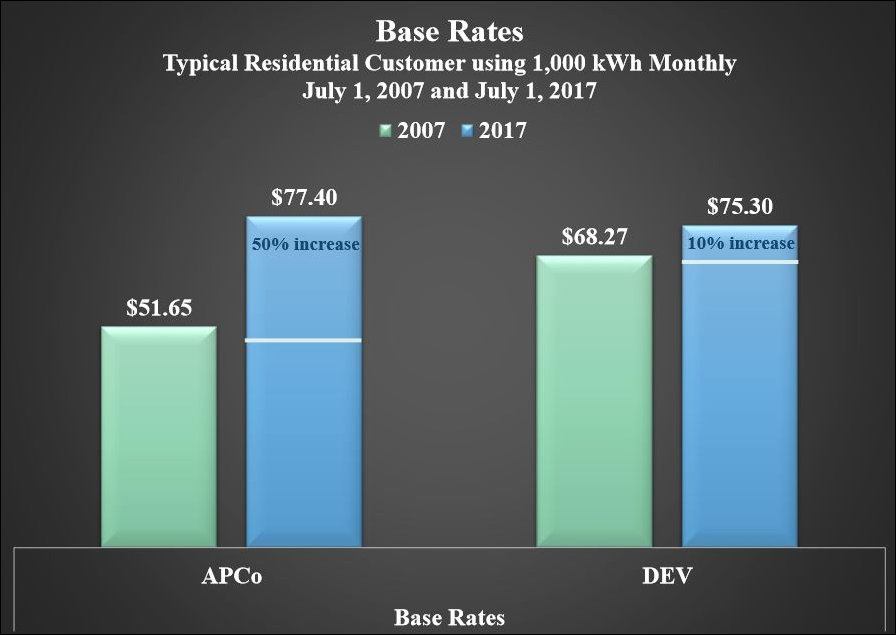

Base rates, the rates that were frozen by 2015 legislation, are the biggest component of overall electric rates. A 50% increase in Apco base rates added $25.75 to the monthly bill, making it the driver of its higher electric rates. By contrast, a mere 10% increase in Dominion base rates added $7.03.

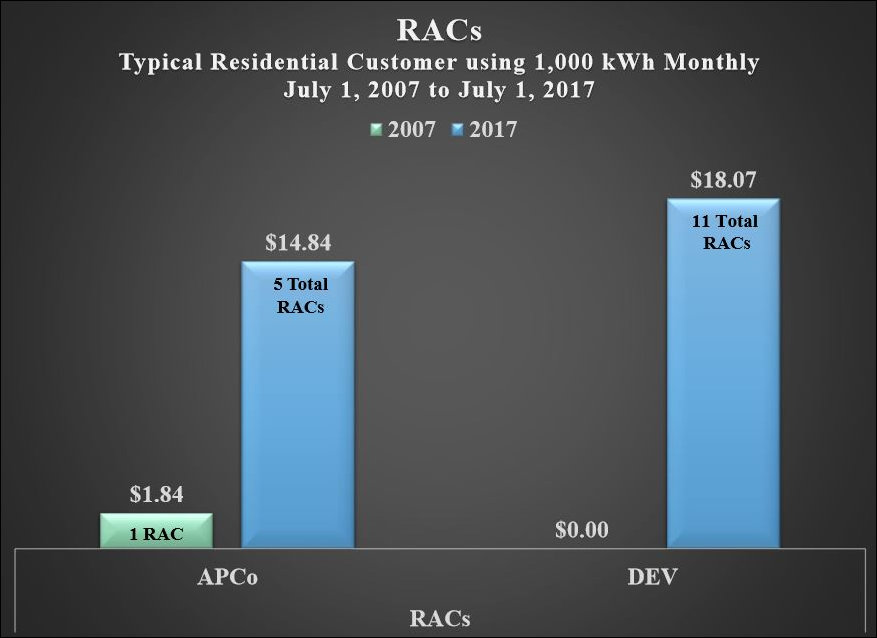

RACs have been a major contributor to higher costs for both utilities. By adding four additional rate “riders” since 2007, Apco pumped up its average household bill by $13.00. Dominion added 11 rate riders, accounting for $18.07 in new expense passed on to rate payers.

Understanding how electricity rates are constructed illuminates corporate strategy.

For example, Dominion is facing potential multibillion-dollar liabilities to safely dispose of the coal ash at four of its power stations. Some of the costs are rolled into the base rate and some can be passed along to rate payers in the form of a rider. If the rate base stays frozen, those costs cannot be passed along to ratepayers, and shareholders will take a hit. Last month Dominion released a study showing a range of alternatives for burying the coal ash; one option, creating a central landfill to accommodate the material from the three largest coal-ash sources, could cost more than $4 billion. It’s not clear from an accounting perspective how much of that liability would be assigned to the base rate and how much could be passed through to rate payers. But, if Dominion were compelled to bury its coal ash in lined landfills, the utility potentially could take a body blow to the bottom line. Could coal ash liabilities have factored into Dominion’s suggestion last week that it was time to end the freeze? It’s a question worth asking.

Another example: Both Dominion and Apco are bringing more renewable sources, mainly solar and wind, into their electric generating portfolios. Renewables have high up-front capital costs (which would be recouped through a Rate Adjustment Clause), modest operating costs (recouped through base rates), and zero fuel costs (addressed by the Fuel Adjustment Clauses). Integrating renewables into the fuel mix would push electric rates higher initially but be almost immune to prices increases in the future.

Bacon’s bottom line: Different categories of cost have differential impacts on Apco and Dominion and their customers, depending upon their fuel mixes and upon how those costs are treated from an accounting point of view. Apco and Dominion make it their business to understand how those costs flow through to their bottom lines, and they adjust their corporate strategies accordingly. To defend the public interest, state officials need to understand the factors that drive their actions as well.