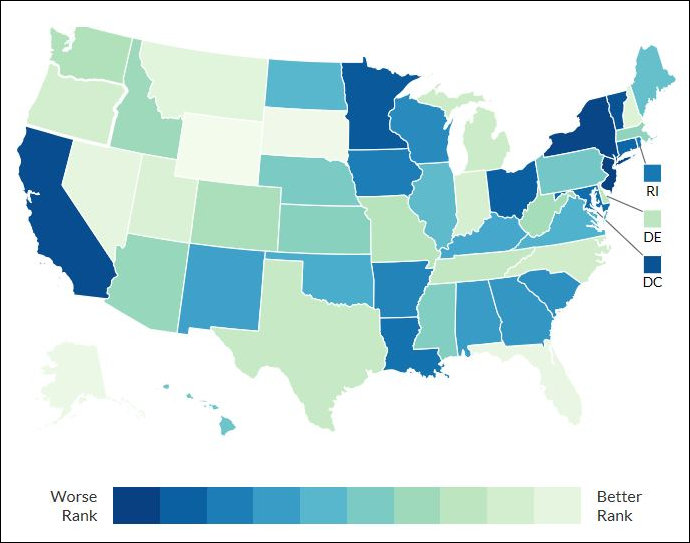

Source: The Tax Foundation

Just a reminder: Virginia is not a low-tax state. According to the Tax Foundation’s 2018 ranking of state business tax climate, Virginia scored 31st. While the Old Dominion scores pretty well for corporate taxes and sales taxes, it flunks the grade for individual taxes and unemployment insurance taxes.

Here are the category rankings:

Overall rank: 31

Corporate taxes: 6

Individual taxes: 40

Sales taxes: 10

Property taxes: 31

Unemployment insurance taxes: 41

If you are taxaphobic, the best states in the country are Wyoming, South Dakota, Alaska, and Florida. The worst: New Jersey, New York, California, Vermont, and Minnesota.

On the positive side, higher taxes pay for higher levels of services and amenities such as schools, higher-ed, public safety, roads, mass transit, Medicaid, and social services. On the negative side, you don’t always get what you pay for. In many states, public employee unions have captured a big share of tax revenue, and lots of the money has been spent to little effect. Tax-paying citizens continue to vote with their feet, leaving high-tax states and seeking opportunity in lower-tax states.

Update: “The Tax Foundation’s State Business Tax Climate Index (SBTCI) that you cited actually is not primarily intended to be reflective of business tax burdens in states,” notes Stephen Moret, president of the Virginia Economic Development Partnership (VEDP). “It is more of a ranking of tax complexity or tax structure than it is a ranking of state/local tax burdens.” See his full observation highlighted in the comments section.